See also the DAO that will control this software.

Help needed! - see at the bottom.

We have improved API, but this new API is not yet tested.

This project has anti-theft allowing to use it as the global backbone of carbon accounting. (Nothing prevents to use it for small accounting, too.)

This is the only reasonable carbon accounting project for the global scale, because it has world-best anti-theft protection to scale to store and transfer trillions dollars of value. Carbon thieves exist: I was not paid $1000 for this project by Ingo Puhl (I consider him a disappeared criminal.) from South Pole and $500 by Houston Impact Hub. So every time I do a climate project, I was stolen, total $1500.

The project is in desperate need of a few thousand dollars to pay to a certified error-checker. We also need to finish development of carbon accounting by creating an UI (a site) for accounters. Donate: https://gitcoin.co/grants/177/social-charity-tokens-and-dao-carbon-accounting

See also this repository for the frontend UI. But better to use DAOstack voting system to create this site.

For big amounts of carbon, this software can be installed on Ethereum, for energy-efficient accounting of small amounts it can be used xDAI blockchain.

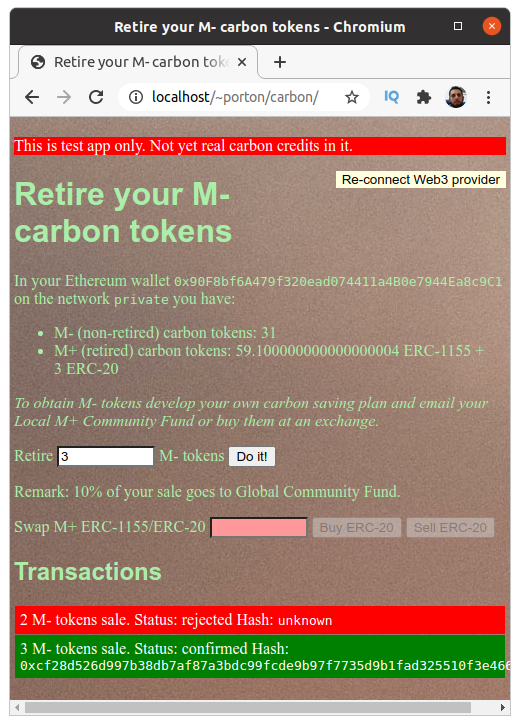

Demo (switch to Ropsten network): https://arweave.net/-hwwwN8tPm0CrnW8Bn1NH24SrDnuShQOX7ZQ8M3JSig

See also https://youtu.be/R8q0rlrQqQc

It is a ERC-1155 token. I have wrappers to convert it to ERC-20.

Prerequisites: Node.js, yarn, GNU make.

To install contracts:

yarn install

GLOBAL_COMMUNITY_FUND=0x<THE-DAO-CONTRACT-ADDRESS> npx buidler deploy --network NETWORK(replace NETWORK by mainnet (or another network we will choose later) when doing

the real deployment, for testing you can use --network buidlerevm).

yarn install

npx buidler testRun Ganache (a blockchain for testing)

npx ganache-cli -d(This command should be kept running during the entire test!)

Notice the private key (1) (it is 0x6cbed15c793ce57650b9877cf6fa156fbef513c4e6134f022a85b1ffdd59b2a1,

a private key to be used only for testing).

To install the Web application (dApp) with this test blockchain:

yarn install

GLOBAL_COMMUNITY_FUND=0xFFcf8FDEE72ac11b5c542428B35EEF5769C409f0 npx buidler deploy --network ganache

makeThen copy the folder out/ui/ to a Web server and run the app in that folder.

Configure your crypto Web browser to use localhost:8545 if testing with Ganache.

You will see zero tokens at your account.

Run

PRIVATE_KEY=0x6cbed15c793ce57650b9877cf6fa156fbef513c4e6134f022a85b1ffdd59b2a1 RECIPIENT=<YOUR-ADDRESS> AMOUNT=100 npx buidler run scripts/mint-nonretired.js --network ganache(Replace <YOUR-ADDRESS> by the Ethereum address you use in the browser.)

This will add 100 M- tokens to this address. Reload the app page and now you can retire tokens.

Note that the above testing procedure does not show a real method of producing M- tokens (though this test script could be used to mint real tokens for real authorities, it is not convenient and error prone). This is intentional, as the procedure of registering carbon credits can be done only in conjunction with "Design And Implementation Of M+C Community Fund Management Platform" (another bounty), because the procedure of registering tokens needs to be a part of a DAO to be developed as a part of that bounty. However, I created the necessary smart contract methods for accomplishment of that bounty.

Note that I also don't directly support storing IDs of the "authorized signers" when creating a carbon credit record, as required in the tech specification. Instead I allow to pass a hash of an Arweave file. This file should contain additional data, including the IDs of these signers. The data format can be decided later, but it may be JSON and may contain IDs of authorized signers. If it is necessary to store these "signers" in an Ethereum chain, it is easy to modify my contract before the final release.

See doc/tree.odg or doc/tree.pdf.

There are basically two kinds of tokens:

-

non-retired carbon tokens;

-

retired carbon tokens.

Each non-retired token may have a token owner. Each token has either a parent token or no parent token.

The token owner is called an carbon credit authority.

So, we have the tokens and a tree of tokens of child/parent relationships between authorities rooting in non-retired tokens with no parents (there may be more, see the next paragraph).

Remark: In fact they are not trees but directed graphs.

There may be token owners who are not authorities (either tokens unrelated with our carbon counting project (That's fine, there is no reason to use my project only for carbon counting, it may be useful also for something other.)

A token owner can change its parent at any moment of time by its own will. (But if he does this, his token is disabled (unless now has no parent) and his swap limits (see below) are reset to zero until its new parent wishes to increase his limits.)

TODO: Maybe we instead should have many-to-many child-parent relationship, with child enabling/disabling and parent setting limits? See also Backward flow

Anybody can swap a child token he holds for an amount (by an exchange rate set by parent) of its parent token.

It is useful to build a hieararchical system of authorities with roots in international carbon tokens.

It is also useful to swap parent token back for its child tokens.

First, we can't make this operation impossible because the DAO (or other entity) controlling a child token can "eat" parent tokens and mint according value of child tokens.

So, the remaining issue is whether we should make impossible for a DAO to avoid swapping parents for childs.

The answer is "no", it should be always possible. The reason is the following: If the parent token is a carbon credits token, then disabling its swapping for a child would somehow devalue carbon credits what is clearly bad for the environment. So we should make swapping always possible.

Among the usual Ethereum security measures like making tokens "owned" by someone restricting others' right for manipulation of the token, there are the following "special" security measures.

The amount of child tokens that can be swapped for a parent token is limited by an algorithm parametrized with the following numbers:

-

C - max swap amount (a number of tokens);

-

P - swap credit period (a number of seconds).

This is to avoid some entity maliciously or erroneously minting producing a giant number of tokens and then swapping them for a valuable parent token faster than an ancestor token owner removes it from its descendants.

The idea is that one can swap up to C tokens per swap period P.

TL;DR: The algorithm is as follows:

-

At any moment of time we are either in a swap credit or no (intially we are not in a swap credit).

-

At any moment of time anyone can swap up to c token, (c is called the remaining swap credit).

-

c = C if we were not in a swap credit.

-

c is set to C when we enter into a swap credit.

-

c is decreased by s where s is the swap amount at every swap.

-

We enter swap credit if a swap not inside a swap credit happens.

-

We exit from swap credit as soon as P seconds passes since last entering swap credit.

There is also possible to set a single (not recurring) flow limit, that just decreases with every eligible transfer.

In the case if somebody needs to exceed a swap credit amount for a legitimate reason he may write an email to the parent token owner asking to raise the limits.

I will use the word theft to denote both malignant generation of tokens and generating too big number fo tokens by mistake.

Any authority token can be disabled.

Anyone upward in the tree can disable any of its descendants.

Disabled authority cannot create credits, disabled tokens cannot be exchanged to parent tokens.

Remark: A malignant or otherwise weird user may produce too long chain of descendants of some token, making it impossible to disable all the descendants because of gas limitations. In this case, only some of the ancestors in the chain should be disabled.

Disabled tokens also can't enable/disable other tokens.

Remark: Because it is in reality a directed graph, not a tree, two tokens in the tree could be disabled by each other. We prevent the special case of an authority disabling itself, because otherwise it can't enable itself back.

See also https://ethereum.stackexchange.com/q/88235/36438

In the case if a big enough theft is detected somewhere in the tree of authorities, the blamed entity and possibly several its ancestors should be disabled as soon as possible, while they did not yet swap their tokens to the upper levels.

After it is disabled, ones holding invalid tokens should be asked to burn them.

If enough tokens were burn and the reason of the theft was eliminated, the disabled tokens should be enabled again.

Should we allow authorities (e.g. GCF) to burn child tokens (also their own tokens?) It is a notable dilemma between democracy and personal freedom.

TODO: More tests.

There are two bridges built on different principles. ERC20OverERC1155.sol has a bug

but ERC20LockedERC1155.sol doesn't (so I recommend to use it).

ERC20LockedERC1155.sol

It converts tokens from ERC-1155 to ERC-20 and back with special contract calls. In fact it is a simple DEX.

ERC20OverERC1155.sol

Our ERC-20 tokens wrap corresponding ERC-1155 so that the amounts on accounts of our ERC-20 and the corresponding ERC-1155 token are always equal. Transfer or approval of one of these two tokens automatically transfers or approves also the other one.

Our ERC-20 tokens have a bug (do not fully conform to the ERC-20 standard): the system is not notified of ERC-1155 transfers and other events by the corresponding ERC-20 events.

The practical implications of the bug are as follows:

-

A user may be not notified (e.g. by email sent by EtherScan.io) about a transfer or other event with his token.

-

Some software for re-creating a new ERC-20 token with the same balances as our token may produce a new token with wrong balances.

-

Other failures.

This bug probably could be fixed, but:

-

Fixing it would significally increase gas usage, what is not green.

-

Most ERC-20 software does work correctly with our tokens despite this bug.

-

ERC-20 is an old legacy standard, ERC-1155 tokens should be used instead. It is expected that after a few years most Ethereum wallets and exchanged will support ERC-1155, so ERC-20 support is just a temporary measure.

-

You also should prefer to use the ERC-1155 version, because it uses less gas.

Documentation comments in contracts.

Test batch transfers.

See also TODO and FIXME comments in the source.

Improve solhint rules.

Add freely mintable tokens. It is useless for carbon, but useful for other applications.

If somebody wants to operate in the system without having an Ethereum account, an authority may arrange for him for somebody to hold a wallet with a private key (or a smart wallet, e.g. a DAO if the money hold a big to be sure not one M+ representative is in control of that account) for him and issue for him M- and M+ tokens to this wallet instead of his own wallet (and do trade/exchange operations for him instead of himself). The amount of transfers/swaps may be restricted by using a smart wallet as such a "bank account".

Which tokens do you have?

Anybody can create his own two tokens:

- non-retired carbon credits.

- retired carbon credits.

Each authority has its own token for carbon credits that could be exchanged for the token of its upper level issuer and ultimately for international tokens.

There are both ERC-20 and ERC-1155 tokens. Which tokens should I use?

Our ERC-20 tokens wrap corresponding ERC-1155 so that the amounts on accounts of our ERC-20 and the corresponding ERC-1155 token are always equal. Transfer or approval of one of these two tokens automatically transfers or approves also the other one.

You should use ERC-1155 tokens if you can, because they are both more secure (there is a security bug in ERC-20 that affects for example crypto exchanges) and use less gas. But many legacy softwares don't support ERC-1155, in this case use ERC-20.

Some DAOs cannot be ERC-1155 smart wallets (because ERC-1155 smart wallet must implement certain functions that may be missing in a DAO). The trouble is solvable by making the DAO to control a separate contract acting as a ERC-1155 smart wallet. Another solution is to use (one of the three of) my ERC-20 wrappers.

Voting with balance of my tokens is impossible: Somebody could vote, transfer to another account and vote again (many times). It could be made by storing the token balance (as in MiniMeToken) at the beginning of the vote period, but that requires complex code and rather much gas (electricity, carbon) usage on every transfer of. As a cheaper and easier alternative solution I propose to vote not with balances of tokens but instead transfer the voted amount of such a token to the fund's account (as a side effect, we get more donations). Note also that this solution has a deciency: With quadratic voting it becomes possible for spoofers to transfer little amounts of it to many of their friends and ask them to vote for them. Maybe we should give up quadratic voting and use old-school linear voting?

If you set your swap limit to N and later make it M, then (surprise!) a hacker sometimes can send N+M tokens. This is a hard to deal with trouble. So, I just recommend the following to frontend developers: Set new swap limit only when the previous one has almost emptied or expired, and do only set a new swap limit when a recurring swap limit (if now the limit is recurring) is near to expiration (but no too near because otherwise the new period may start before your transaction to set the new swap limit confirms). Alternatively, you can set your swap limit to (non-recurring) low enough value before setting the actual new value for a swap limit (this however creates an inconvenience for users, as during some time they will be unable to swap). A radical solution would be to set swap limit to be calculated as a sum of several (e.g. two) values that could be set independently. But that would harden the system somehow.

Quadratic voting anti-sybill can be done by using Fuse.io network and GoodDollar private keys as the keys for voting. A user of GoodDollar would not give to somebody other his private key easily because the key costs money. So it is a good anti-sybill. As a consequence, we should think of deploying our entire system on Fuse. Another alternative would be Matic.

Note that GoodDollar identity is also deloyed on Ethereum mainnet, so we could just as well use mainnet, but currently mainnet transactions are too costly. Transfers of M+ may have more harm to the environment than good (but in the future Ethereum transactions cost is expected to come down much due to ETH2 project.)

Let carbon token X is exchangeable for carbon token Y. That is for example X is Paris carbon token, Y is France carbon token.

If some X was stolen, its value should decrease, therefore the exchange rate should decrease and after decreasing exchange rate the allowed amount of X exchanged for Y should increase. This emergency can be done as first decreasing exchange rate and then increasing amount.

If some Y was stolen, its value should decrease, therefore the allowed amount of X exchanged for Y should reamin the same and the exchange rate should increase.

The conclusion: In all theft cases the exchange rate can be changed without prior change of allowed amount. This allows the exchange rate to be controlled separately, e.g. by ChainLink aggregating multiple sources.

ExchangeRateSetter allows anyone to set exchange rate coefficient for exchange of child to parent

token from a ChainLink feed.

doc/ folder (outdated). Use LibreOffice to read these files.

If you find this project useful, donate:

- https://paypal.me/ViktorPorton

- https://www.patreon.com/porton

- BitCoin 174HGm3PfoxYZkx59hoxVseQZzW5KnCPij

- Ethereum and other: https://gitcoin.co/grants/177/social-charity-tokens-and-dao-carbon-accounting

See https://gitcoin.co/issue/29033 for a work request to make this project usable by people.

I tried to integrate holographic consensus from https://github.com/ajsantander/hc but failed to compile that package. Can anyone with good Node.js skills help?

I want to change that package to vote not just by locking tokens but by paying in tokens: this will help to spend less carbon on voting than teh voting saves.

On yarn start I have:

✔ Start a local Ethereum network

✔ Check IPFS

❯ Setup before publish

✔ Running prepublish script

✔ Applying version bump (major)

✔ Building frontend

❯ Deploy contract

⠇ Compile contracts

Deploy 'HCVoting' to network

Generate deployment artifacts

Determine contract address for version

Prepare for publish

Publish app to aragonPM

Fetch published repo

Create DAO

Open DAO

node:internal/fs/utils:344

throw err;

^

Error: EAGAIN: resource temporarily unavailable, write

at Object.writeSync (node:fs:884:3)

at printErrorAndExit (/home/porton/Projects/hc-burn/node_modules/@aragon/cli/node_modules/truffle/build/webpack:/~/source-map-support/source-map-support.js:437:1)

at process.emit (/home/porton/Projects/hc-burn/node_modules/@aragon/cli/node_modules/truffle/build/webpack:/~/source-map-support/source-map-support.js:450:1)

at process._fatalException (node:internal/process/execution:170:25) {

errno: -11,

syscall: 'write',

code: 'EAGAIN'

}