Why use a bank when you can just stuff your money under a mattress?

One of the primary keys in setting up a business is having capital. If you don't have one, you must be seeking business capital.

One of the primary keys in setting up a business is having capital. If you don't have one, you must be seeking business capital.

Bankera, an ambitious project to build a neobank for the digital era, has started to offer payment accounts to individual and business clients as a low-cost, fast and convenient alternative to traditional bank accounts. Individual and business clients who sign up to the service can already enjoy dedicated European IBAN accounts to send and receive funds via SEPA and SWIFT transfers. All clients can send and receive funds from cryptocurrency exchanges.

Bankera, an ambitious project to build a neobank for the digital era, has started to offer payment accounts to individual and business clients as a low-cost, fast and convenient alternative to traditional bank accounts. Individual and business clients who sign up to the service can already enjoy dedicated European IBAN accounts to send and receive funds via SEPA and SWIFT transfers. All clients can send and receive funds from cryptocurrency exchanges.

Cryptocurrencies and open banking are two terms that usually don't go together. But there is a huge untapped potential within this unexpected duo.

Cryptocurrencies and open banking are two terms that usually don't go together. But there is a huge untapped potential within this unexpected duo.

As much as digitization and cyber simplified banking, the Fintech sector has left digital payment activity exposed to malicious and suspicious activity.

As much as digitization and cyber simplified banking, the Fintech sector has left digital payment activity exposed to malicious and suspicious activity.

Annual tech predictions from venture capitalist, Bernard Moon. On NFTs, 3D-printing, meat substitutes, cryptocurrencies and commercial banking

Annual tech predictions from venture capitalist, Bernard Moon. On NFTs, 3D-printing, meat substitutes, cryptocurrencies and commercial banking

It is the financial system that could be easily corrupt and not the crypto one in funding terror all over the world.

It is the financial system that could be easily corrupt and not the crypto one in funding terror all over the world.

The future of money is in the realm of decentralization. Can BlockFi really take over the banking industry? Click here to find out.

The future of money is in the realm of decentralization. Can BlockFi really take over the banking industry? Click here to find out.

If you have stepped into the arena of business and established your company, it is adamant that you must be encountering Gross Margin and Depreciation very soon. Every company owner wants to estimate the cost of business operations and the revenue generated from it. This is the reason which makes gross margin and depreciation an essential part of business concerns. Let’s narrow down both terms one after another and the relationship among them.

If you have stepped into the arena of business and established your company, it is adamant that you must be encountering Gross Margin and Depreciation very soon. Every company owner wants to estimate the cost of business operations and the revenue generated from it. This is the reason which makes gross margin and depreciation an essential part of business concerns. Let’s narrow down both terms one after another and the relationship among them.

How this startup is reshaping global finance by making capital a commodity.

How this startup is reshaping global finance by making capital a commodity.

Banking and finance instruments have slowly evolved from being exclusively accessible to the fortunate few to becoming widely accessible to the masses, who are now able to transact with relative ease and accumulate wealth.

Banking and finance instruments have slowly evolved from being exclusively accessible to the fortunate few to becoming widely accessible to the masses, who are now able to transact with relative ease and accumulate wealth.

Today, finding the best investments takes more than looking for market leaders. The investors today look for companies that has secure systems apart from profit generation, huge market share, strong growth potential, or a reasonable valuation. cybersecurity is a crucial growth-oriented strategy for their portfolio.

Today, finding the best investments takes more than looking for market leaders. The investors today look for companies that has secure systems apart from profit generation, huge market share, strong growth potential, or a reasonable valuation. cybersecurity is a crucial growth-oriented strategy for their portfolio.

The 2020 version of DeFi looked like a radical and frankly weird alternative to legacy banking. But in 2021, we might start moving to DeFi v.2 – one that banks and corporations can embrace. However, it will be very different from the sushi swaps and yield farming crazes that we've seen so far, with bank-friendly projects like Cryptoenter taking the lead.

The 2020 version of DeFi looked like a radical and frankly weird alternative to legacy banking. But in 2021, we might start moving to DeFi v.2 – one that banks and corporations can embrace. However, it will be very different from the sushi swaps and yield farming crazes that we've seen so far, with bank-friendly projects like Cryptoenter taking the lead.

SEC's decision to declare Coinbase's Lend program unregistered security offering unintentionally saved Coinbase from the same fate as BlockFi, Celsius, Genesis

SEC's decision to declare Coinbase's Lend program unregistered security offering unintentionally saved Coinbase from the same fate as BlockFi, Celsius, Genesis

Bitcoin is now worth over $8,500. As such, it is only natural that this community-driven alternative to banks has drawn interest from traders, investors, and even regulators. Governments are concerned about Bitcoin, sprouting blockchain networks, and how it could impact their operations. Here, it is important to note that the control of money supply is vital for a centralized economy to thrive.

Bitcoin is now worth over $8,500. As such, it is only natural that this community-driven alternative to banks has drawn interest from traders, investors, and even regulators. Governments are concerned about Bitcoin, sprouting blockchain networks, and how it could impact their operations. Here, it is important to note that the control of money supply is vital for a centralized economy to thrive.

While the bitcoin community seems fully absorbed by the daily ups and ATHs of bitcoin, it seems that most people have missed what might well be the biggest and most impactful news of the year 2021 for the crypto sector.

While the bitcoin community seems fully absorbed by the daily ups and ATHs of bitcoin, it seems that most people have missed what might well be the biggest and most impactful news of the year 2021 for the crypto sector.

Consumers look for products that enable them to contribute to sustainability. Banks and fintech companies can address this need with innovation.

Consumers look for products that enable them to contribute to sustainability. Banks and fintech companies can address this need with innovation.

I quit my Hong Kong finance job and changed the course of my life through technology. Two years after making the switch into tech and I still love the industry.

I quit my Hong Kong finance job and changed the course of my life through technology. Two years after making the switch into tech and I still love the industry.

"Many of the things you can count, don't count. Many of the things you can't count, really count." - Albert Einstein

"Many of the things you can count, don't count. Many of the things you can't count, really count." - Albert Einstein

Sean Rach, the co-founder of a not-for-profit finance service platform hi, talks about the digital finance ecosystem and the evolution of the crypto markets.

Sean Rach, the co-founder of a not-for-profit finance service platform hi, talks about the digital finance ecosystem and the evolution of the crypto markets.

Making the transition to a work from home arrangement has been a heavy lift for a lot of organizations.

Making the transition to a work from home arrangement has been a heavy lift for a lot of organizations.

New Jersey man's account was closed suddenly after he paid for lunch at Applebee’s.

New Jersey man's account was closed suddenly after he paid for lunch at Applebee’s.

The partnership between The Sandbox and HSBC will have HSBC acquire a plot of land, a virtual real estate in The Sandbox's virtual & Metaverse world.

The partnership between The Sandbox and HSBC will have HSBC acquire a plot of land, a virtual real estate in The Sandbox's virtual & Metaverse world.

Twitter senior secured bank loans- the top of the capital stack- at $0.60 implies that Twitter- for which @elonmusk paid $44 billion- is now worth less than $8B

Twitter senior secured bank loans- the top of the capital stack- at $0.60 implies that Twitter- for which @elonmusk paid $44 billion- is now worth less than $8B

EQIFI is a hybrid platform that combines decentralized finance with centralized finance.

EQIFI is a hybrid platform that combines decentralized finance with centralized finance.

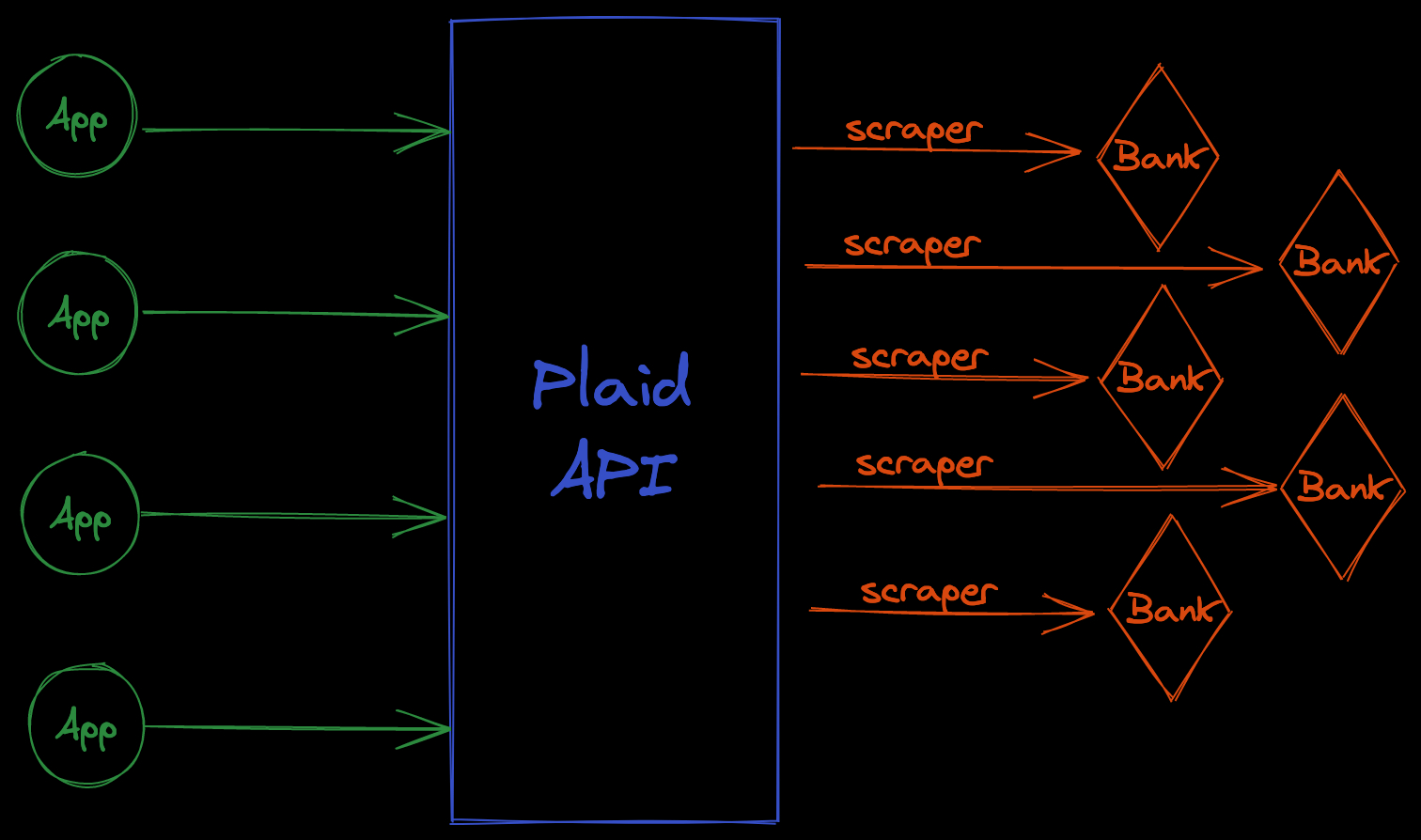

Learn about the pursuit to solve one of the most severe and long-prevailing problems in fintech.

Learn about the pursuit to solve one of the most severe and long-prevailing problems in fintech.

Application programming interfaces (APIs) have been around for 20 years,

but, as Ron Shevlin points out, just one in five community banks in the USA had deployed APIs before 2020, and they aren’t even on the radar of at least 20% of the banks.

Application programming interfaces (APIs) have been around for 20 years,

but, as Ron Shevlin points out, just one in five community banks in the USA had deployed APIs before 2020, and they aren’t even on the radar of at least 20% of the banks.

Total forecast

Total forecast

By now, if you have read about blockchain technology, you might have an idea about its potential. Bitcoin made its spectacular announcement as a result of the financial disaster led by centralized banks and government, back in 2009. But, is bitcoin free from its own vices? Also, after the financial disaster, have banks learned their lesson?

By now, if you have read about blockchain technology, you might have an idea about its potential. Bitcoin made its spectacular announcement as a result of the financial disaster led by centralized banks and government, back in 2009. But, is bitcoin free from its own vices? Also, after the financial disaster, have banks learned their lesson?

We've finally reached a point where the cryptocurrency market is more than just a niche interest.

We've finally reached a point where the cryptocurrency market is more than just a niche interest.

Whether you are craving a burger or Chinese food tonight, there is no need to reach for your wallet or phone to buy it. Food vendors in California are embracing facial recognition — technology that lets you pay with a smile.

Whether you are craving a burger or Chinese food tonight, there is no need to reach for your wallet or phone to buy it. Food vendors in California are embracing facial recognition — technology that lets you pay with a smile.

FinTech is a growing industry at the intersection of technology and financial services. This is a powerful incentive for technological progress, which expands its influence on different sectors of the economy, allowing them to develop. For example, FinTech has been most active in consumer services, banking, money transfers, payments, insurance, asset and capital management. The industry is revolutionizing the way businesses and consumers conduct financial transactions.

FinTech is a growing industry at the intersection of technology and financial services. This is a powerful incentive for technological progress, which expands its influence on different sectors of the economy, allowing them to develop. For example, FinTech has been most active in consumer services, banking, money transfers, payments, insurance, asset and capital management. The industry is revolutionizing the way businesses and consumers conduct financial transactions.

For two years between 2020 and 2022, the US Federal Funds rate was 0.25%.

For two years between 2020 and 2022, the US Federal Funds rate was 0.25%.

Incumbent Banks and financial technology startups (Fintechs) face very different challenges as they navigate the COVID-19 crisis. Despite sharing customers and offering similar products, their business models, how they operate, their balance sheets and culture vary tremendously. Each one of these differences impacts how they will perform during and after the crisis.

Incumbent Banks and financial technology startups (Fintechs) face very different challenges as they navigate the COVID-19 crisis. Despite sharing customers and offering similar products, their business models, how they operate, their balance sheets and culture vary tremendously. Each one of these differences impacts how they will perform during and after the crisis.

The emergence and growth of blockchain technology and the resultant cryptocurrencies has sent shockwaves throughout the financial markets. Cryptocurrencies have changed the way people conduct financial transactions globally. Be it typical mobile money transfers of the payment of goods and services; blockchain technology has been integrated into pertinent aspects of financial transactions.

The emergence and growth of blockchain technology and the resultant cryptocurrencies has sent shockwaves throughout the financial markets. Cryptocurrencies have changed the way people conduct financial transactions globally. Be it typical mobile money transfers of the payment of goods and services; blockchain technology has been integrated into pertinent aspects of financial transactions.

Application Programming Interfaces are an integral part of the emerging digital space. Without them, benefiting from many of today’s habitual financial services would be at least difficult if not impossible. In this piece, Andersen’s experts in FinTech software development will tell how API-based IT solutions contribute to the success of banks and financial organizations.

Application Programming Interfaces are an integral part of the emerging digital space. Without them, benefiting from many of today’s habitual financial services would be at least difficult if not impossible. In this piece, Andersen’s experts in FinTech software development will tell how API-based IT solutions contribute to the success of banks and financial organizations.

In this article, we shall take a closer look at how one can secure his or her bank account and other related ideas.

In this article, we shall take a closer look at how one can secure his or her bank account and other related ideas.

Financial technologies are rapidly transforming from futuristic imaginings into an inextricable component of everyday life. Back in 2016, such services as Apple Pay and Samsung Pay were just entering the global market as newfangled inventions, while today, they are used to processing three times more transactions than those made using conventional plastic bank cards. Mobile apps have since largely replaced bank office branches, and the coronavirus pandemic has only accelerated the trend. Taking into account the rapid pace of development of the fintech sector and speed at which modern users adapt to innovations, our experience of interacting with financial institutions is likely to undergo radical changes over the next few years.

Financial technologies are rapidly transforming from futuristic imaginings into an inextricable component of everyday life. Back in 2016, such services as Apple Pay and Samsung Pay were just entering the global market as newfangled inventions, while today, they are used to processing three times more transactions than those made using conventional plastic bank cards. Mobile apps have since largely replaced bank office branches, and the coronavirus pandemic has only accelerated the trend. Taking into account the rapid pace of development of the fintech sector and speed at which modern users adapt to innovations, our experience of interacting with financial institutions is likely to undergo radical changes over the next few years.

Dear Mr Bank Manager, don’t you think it is more frightening to ignore cryptocurrencies and face being left behind?

Dear Mr Bank Manager, don’t you think it is more frightening to ignore cryptocurrencies and face being left behind?

The future of money is clearly digital, powered by decentralized blockchain technology.

The future of money is clearly digital, powered by decentralized blockchain technology.

Banks in the metaverse is very much a case of “you were so preoccupied with whether or not you could that you didn’t stop to think if you should.”

Banks in the metaverse is very much a case of “you were so preoccupied with whether or not you could that you didn’t stop to think if you should.”

Is online banking causing the death of phsyical banking? 5 top implications of online banking app and digital cards

Is online banking causing the death of phsyical banking? 5 top implications of online banking app and digital cards

For a while now, the fintech sector has taken center stage as consumers are flooded with thousands of tools looking to finetune the way we execute banking processes and communicate with financial institutions.

For a while now, the fintech sector has taken center stage as consumers are flooded with thousands of tools looking to finetune the way we execute banking processes and communicate with financial institutions.

The government's recent stablecoin regulations could shape how the entire cryptocurrency industry evolves.

The government's recent stablecoin regulations could shape how the entire cryptocurrency industry evolves.

Comparatively to traditional cryptocurrencies, a CBDC is centralized, and thus it is regulated by the issuing organization or country.

Comparatively to traditional cryptocurrencies, a CBDC is centralized, and thus it is regulated by the issuing organization or country.

Could crowdfunding be the new frontier for real estate investing? Crowdfunding is an emerging industry alternative to property investment trusts for modern investors looking to gain exposure to real estate.

Could crowdfunding be the new frontier for real estate investing? Crowdfunding is an emerging industry alternative to property investment trusts for modern investors looking to gain exposure to real estate.

The hacker attacks at DeFi protocols are a threat to DeFi's institutional adoption, but with the right precautions, banks can enter the space at minimal risk.

The hacker attacks at DeFi protocols are a threat to DeFi's institutional adoption, but with the right precautions, banks can enter the space at minimal risk.

The most essential difference between Libra and Saga is a governance mechanism. In Saga, the owners of the currency and its "fate" so to speak are the SGA holders. Saga has a built-in democracy to prevent the case of plutocracy.

The most essential difference between Libra and Saga is a governance mechanism. In Saga, the owners of the currency and its "fate" so to speak are the SGA holders. Saga has a built-in democracy to prevent the case of plutocracy.

SWIFT payments are a broken system that help financial institutions at the expense of users but they will soon be disrupted with the help of cryptocurrency,

SWIFT payments are a broken system that help financial institutions at the expense of users but they will soon be disrupted with the help of cryptocurrency,

Daumantas Barauskas, COO of Genome, shares with us Genome's origin story, technology to be excited about and the future of fintech in the Startups interview.

Daumantas Barauskas, COO of Genome, shares with us Genome's origin story, technology to be excited about and the future of fintech in the Startups interview.

Why MS Orleans? — Let's delve into the features that make it a good pick for banking and finance app development.

Why MS Orleans? — Let's delve into the features that make it a good pick for banking and finance app development.

If you were a CEO of a large financial institution three years ago, publicly stating support for Bitcoin would be suicidal.

If you were a CEO of a large financial institution three years ago, publicly stating support for Bitcoin would be suicidal.

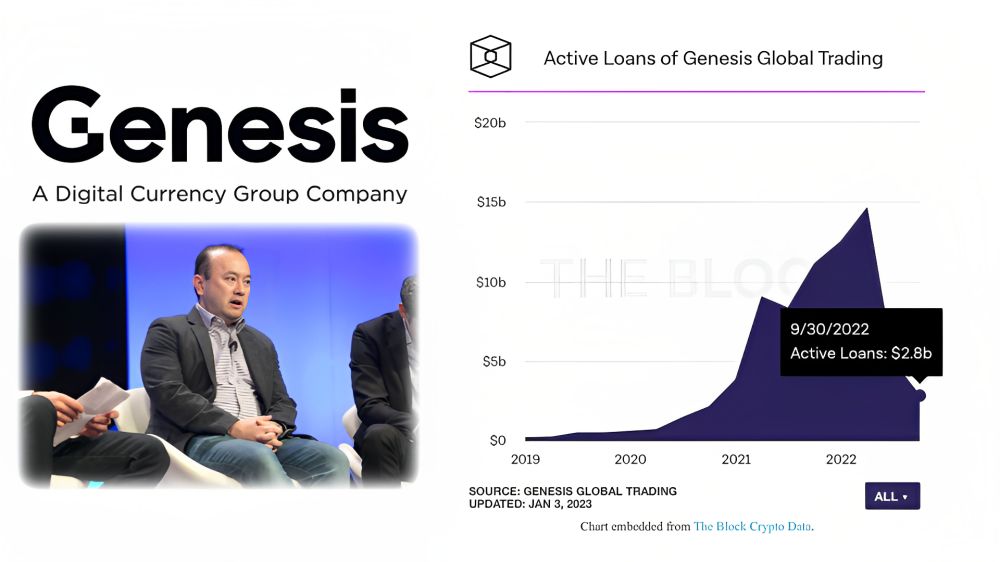

The acti loan book of Genesis Trading lending desk, world's largest payers in crypto shadow banking, explains the ongoing collapse & contagion in crypto markets

The acti loan book of Genesis Trading lending desk, world's largest payers in crypto shadow banking, explains the ongoing collapse & contagion in crypto markets

If someone told us that the beginning of 2020 would change our lives completely and that we’d have to wear masks wherever we go, refrain from hugging people in public, and maintain social distancing even at a bank, I would probably not believe it. I mean, after all, the concept of wearing a mask was strictly forbidden back in the 1920s because it was a sign of robbery. But it all now seems very normal.

If someone told us that the beginning of 2020 would change our lives completely and that we’d have to wear masks wherever we go, refrain from hugging people in public, and maintain social distancing even at a bank, I would probably not believe it. I mean, after all, the concept of wearing a mask was strictly forbidden back in the 1920s because it was a sign of robbery. But it all now seems very normal.

Open banking is on everyone's minds now – and for a good reason. In Latin America, open banking is gluing society together to achieve greater social inclusion. In Africa, fintech companies are engineering a new hub for economic activity, and the latest EU regulations on open banking are provoking an inevitable face-off between challenger banks and traditional financial institutions.

Open banking is on everyone's minds now – and for a good reason. In Latin America, open banking is gluing society together to achieve greater social inclusion. In Africa, fintech companies are engineering a new hub for economic activity, and the latest EU regulations on open banking are provoking an inevitable face-off between challenger banks and traditional financial institutions.

The integration of financial services by non-financial organisations is referred to as embedded finance. This system has changed the way we engage with money.

The integration of financial services by non-financial organisations is referred to as embedded finance. This system has changed the way we engage with money.

Traditional banks Vs. Neobanks

Traditional banks Vs. Neobanks

The stock prices of Credit Suisse and Deutsche Bank are plummeting. Both international investment banks’ shares are currently trading at 0.23x and 0.3x tangible

The stock prices of Credit Suisse and Deutsche Bank are plummeting. Both international investment banks’ shares are currently trading at 0.23x and 0.3x tangible

In the early days of cryptocurrency, storing your digital assets in a wallet file on your computer was a novelty and was part of the attraction of this burgeoning economic system. With some basic technical knowledge, you could mine or mint, store, and transact your digital currencies from your desktop, and eventually your mobile device.

In the early days of cryptocurrency, storing your digital assets in a wallet file on your computer was a novelty and was part of the attraction of this burgeoning economic system. With some basic technical knowledge, you could mine or mint, store, and transact your digital currencies from your desktop, and eventually your mobile device.

A Bank Alternative that takes the best of traditional Banking/Finance, and combines it with DeFi, into one app is the future. Where TradFi and DeFi co-exist.

A Bank Alternative that takes the best of traditional Banking/Finance, and combines it with DeFi, into one app is the future. Where TradFi and DeFi co-exist.

March 10, 2023, was a bad day for Silicon Valley Bank customers but not as much as it was for the bank.

March 10, 2023, was a bad day for Silicon Valley Bank customers but not as much as it was for the bank.

10/7/2022: Top 5 stories on the Hackernoon homepage!

10/7/2022: Top 5 stories on the Hackernoon homepage!

In the US, our financial data should be more easily accessible and transportable. This would make it simpler for more applications to be built to give us views into our financial life (bank account, brokerage, etc…). That in turn would allow different segments of the population to be better served for their needs.

In the US, our financial data should be more easily accessible and transportable. This would make it simpler for more applications to be built to give us views into our financial life (bank account, brokerage, etc…). That in turn would allow different segments of the population to be better served for their needs.

It is hard to believe that soon banks will lose their hegemony, but the process is happening and cryptocurrency is a big part of the reason

It is hard to believe that soon banks will lose their hegemony, but the process is happening and cryptocurrency is a big part of the reason

In this article, we explored the applications of RPA in the banking sector.

In this article, we explored the applications of RPA in the banking sector.

Modern C++20 chrono library usage in quantitative finance for fixed income securities pricing

Modern C++20 chrono library usage in quantitative finance for fixed income securities pricing

CEO Greg Becker received $9.9 million in compensation, while two other executives received $4.6 million and $3.6 million, respectively.

CEO Greg Becker received $9.9 million in compensation, while two other executives received $4.6 million and $3.6 million, respectively.

In the banking sector, digital transformation is long overdue. It’s the pandemic that caused a rapid spike in customers’ demand for digital channels.

In the banking sector, digital transformation is long overdue. It’s the pandemic that caused a rapid spike in customers’ demand for digital channels.

Virtual economies have become increasingly intertwined with the physical world. How could this change how we approach our in-game finances?

Virtual economies have become increasingly intertwined with the physical world. How could this change how we approach our in-game finances?

Chase sapphire reserve credit card review and analysis of whether the rewards justify the high annual fee.

Chase sapphire reserve credit card review and analysis of whether the rewards justify the high annual fee.

Over the years, analysts and environmentalists have constantly called Bitcoin mining an energy-intensive venture. This has brought a continuous spotlight on Bit

Over the years, analysts and environmentalists have constantly called Bitcoin mining an energy-intensive venture. This has brought a continuous spotlight on Bit

Any company, be it a startup or an enterprise, that needs to collaborate with a legacy financial institution has several hurdles to overcome on the way.

Any company, be it a startup or an enterprise, that needs to collaborate with a legacy financial institution has several hurdles to overcome on the way.

2021 Noonies Nominee General Interview with Rad Sidwell-Lewis. Read for more on Investments, Finance, Tech, Entrepreneurship, Travel and Startups.

2021 Noonies Nominee General Interview with Rad Sidwell-Lewis. Read for more on Investments, Finance, Tech, Entrepreneurship, Travel and Startups.

How can QR codes help you acquire more revenue and customers

How can QR codes help you acquire more revenue and customers

Traditional financial systems are in trouble. DeFi is trying to fix that.

Traditional financial systems are in trouble. DeFi is trying to fix that.

Basics of Baas

Basics of Baas

By supporting incubators, accelerators, and other innovation hubs, Nigeria can create an environment that nurtures home-grown FinTechs...

By supporting incubators, accelerators, and other innovation hubs, Nigeria can create an environment that nurtures home-grown FinTechs...

Are we heading to a bank crisis in the US?

Are we heading to a bank crisis in the US?

As software engineers, we strive to better our craft and leave a lasting mark on the organizations we work for. Throughout our careers, we balance two types of knowledge: the combination of business domain and technical stack is our bread and butter. Sometimes we might value the business domain over the technical stack and vice versa as we expand our toolkit. For example, we might work at a financial institution (let’s call it Acme Investment Bank) for a broad domain, but where the tech stack is not bleeding edge. On the other hand, we might roll the dice and work for a firm that has a bleeding-edge tech stack but where the domain is very specific, like a company that sells wine to your pets.

As software engineers, we strive to better our craft and leave a lasting mark on the organizations we work for. Throughout our careers, we balance two types of knowledge: the combination of business domain and technical stack is our bread and butter. Sometimes we might value the business domain over the technical stack and vice versa as we expand our toolkit. For example, we might work at a financial institution (let’s call it Acme Investment Bank) for a broad domain, but where the tech stack is not bleeding edge. On the other hand, we might roll the dice and work for a firm that has a bleeding-edge tech stack but where the domain is very specific, like a company that sells wine to your pets.

Before the pandemic, many businesses did not even think about shifting to e-commerce, but then went online and completely automated their processes in a matter of weeks. I asked Mike Shafro, xpate CEO, what role paytech partners play during the transition, which payment solutions are here to stay and how the shift to e-commerce affects the safety of funds.

Before the pandemic, many businesses did not even think about shifting to e-commerce, but then went online and completely automated their processes in a matter of weeks. I asked Mike Shafro, xpate CEO, what role paytech partners play during the transition, which payment solutions are here to stay and how the shift to e-commerce affects the safety of funds.

The number of fintech companies that are in Finland has seen amazing growth over the years, with the country currently housing approximately 180 companies and covering all the different field of fintech such as:

The number of fintech companies that are in Finland has seen amazing growth over the years, with the country currently housing approximately 180 companies and covering all the different field of fintech such as:

The crypto revolution has helped out fintech startups in ways other than one. Here are some of the top benefits of crypto to fintech companies in 2022.

The crypto revolution has helped out fintech startups in ways other than one. Here are some of the top benefits of crypto to fintech companies in 2022.

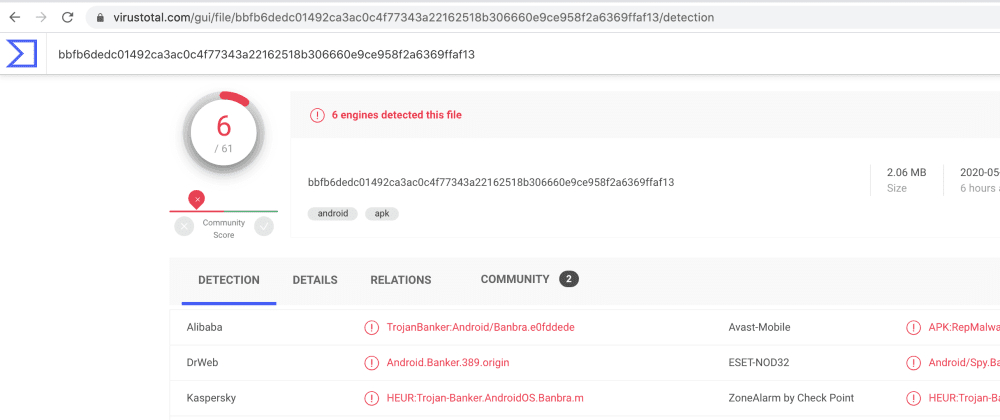

Android malware apps are nothing new, but this one is of particular interest in how it implements no such functionality that can be readily detected by security products. The apps named DEFENSOR ID and Defensor Digital rely mainly on Android's Accessibility Service to conduct malicious activities, and go undetected.

Android malware apps are nothing new, but this one is of particular interest in how it implements no such functionality that can be readily detected by security products. The apps named DEFENSOR ID and Defensor Digital rely mainly on Android's Accessibility Service to conduct malicious activities, and go undetected.

As small-scale startups scrambled to make payroll while the future of the tech industry stood threatened, many of its prominent leaders looked for ways to help.

As small-scale startups scrambled to make payroll while the future of the tech industry stood threatened, many of its prominent leaders looked for ways to help.

Wise, the leading embedded banking FinTech, that offers business banking via partnerships, announced today that it has closed a $12M Series A.

Wise, the leading embedded banking FinTech, that offers business banking via partnerships, announced today that it has closed a $12M Series A.

The greater relationship between AI and fintech can help the financial industry combat fraud more efficiently.

The greater relationship between AI and fintech can help the financial industry combat fraud more efficiently.

Robo advising isn't just a buzzword. In the U.S. today, there are already $980 million in assets managed by robo advisors. These aren’t slowing down anytime soon. In fact, they’re growing by a rate of 27% annually.

Robo advising isn't just a buzzword. In the U.S. today, there are already $980 million in assets managed by robo advisors. These aren’t slowing down anytime soon. In fact, they’re growing by a rate of 27% annually.

Online banking is on a steady path to success, surpassing traditional financial institutions in reliability, convenience, and transaction speed. Still, with more financial services software companies joining the race, users become increasingly picky and difficult to impress. To keep that competitive edge, the service has to offer features that are both desirable and original. This article is an overview of the most feasible directions to explore.

Online banking is on a steady path to success, surpassing traditional financial institutions in reliability, convenience, and transaction speed. Still, with more financial services software companies joining the race, users become increasingly picky and difficult to impress. To keep that competitive edge, the service has to offer features that are both desirable and original. This article is an overview of the most feasible directions to explore.

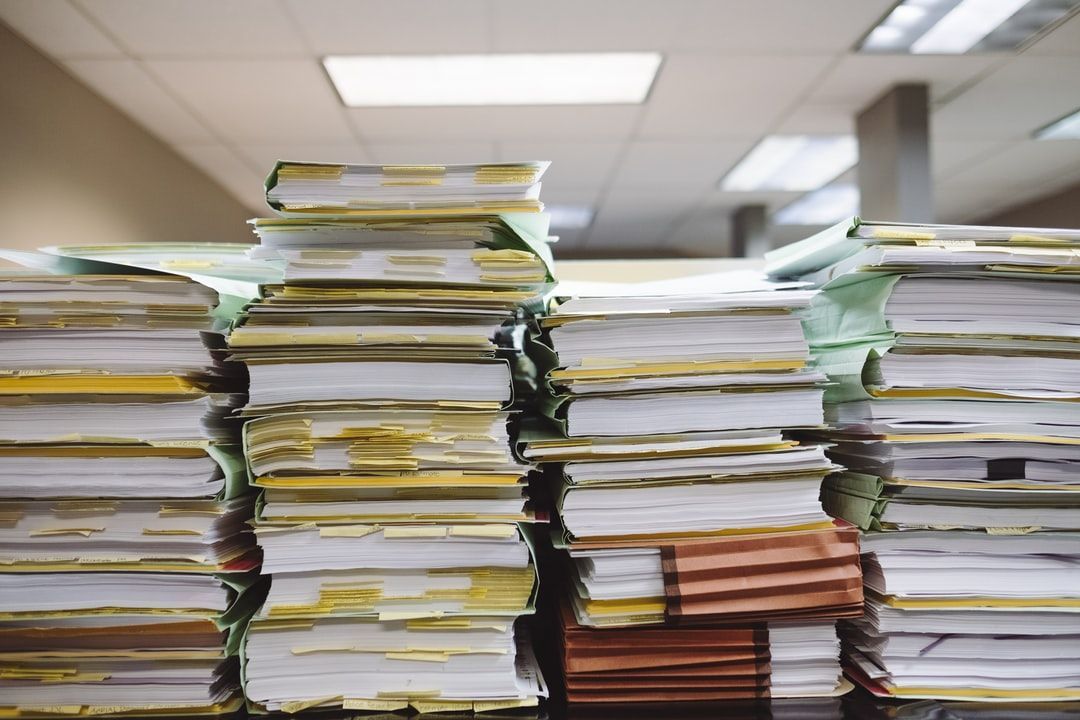

Document Automation is the perfect start to digital transformation. It offers a low-risk investment with immediate returns for banks.

Document Automation is the perfect start to digital transformation. It offers a low-risk investment with immediate returns for banks.

Should you switch to a challenger bank in 2021? Will fintech really make a difference in how you manage your money? Find out if you should change your bank.

Should you switch to a challenger bank in 2021? Will fintech really make a difference in how you manage your money? Find out if you should change your bank.

How will the banks of tomorrow operate, look, grow and thrive in a budding fintech environment and increasingly globalised market?

How will the banks of tomorrow operate, look, grow and thrive in a budding fintech environment and increasingly globalised market?

Decentro is thrilled to announce the country’s first-ever fintech fellowship program for young developers & final-year graduates. Apply now!

Decentro is thrilled to announce the country’s first-ever fintech fellowship program for young developers & final-year graduates. Apply now!

The digital identity solution market revenue volume was $22.9 billion, while according to experts, it will grow to $70.7 billion by 2027.

The digital identity solution market revenue volume was $22.9 billion, while according to experts, it will grow to $70.7 billion by 2027.

Learn how banks can leverage conversational AI and stay relevant in the age of FinTech including the rise of contactless payment methods, omnichannel, and more.

Learn how banks can leverage conversational AI and stay relevant in the age of FinTech including the rise of contactless payment methods, omnichannel, and more.

Banking as a Service or BaaS is an advanced banking model. See how it works, its benefits, and its challenges. Read now.

Banking as a Service or BaaS is an advanced banking model. See how it works, its benefits, and its challenges. Read now.

The world of finance is a very diverse and constantly changing environment that combines tradition and innovation. On the one hand, we have conventional financial mediums like fiat money, precious metals, and stocks that have been well tested during recent centuries (some of them even longer).

The world of finance is a very diverse and constantly changing environment that combines tradition and innovation. On the one hand, we have conventional financial mediums like fiat money, precious metals, and stocks that have been well tested during recent centuries (some of them even longer).

Wish to unlock new revenue paths for your business and that too from your existing products? Say hello to embedded banking & finance!

Wish to unlock new revenue paths for your business and that too from your existing products? Say hello to embedded banking & finance!

Know 5 benefits & top 10 banking chatbot use cases. How a chatbot is evolving in the banking sector to both bankers and customers.

Know 5 benefits & top 10 banking chatbot use cases. How a chatbot is evolving in the banking sector to both bankers and customers.

This article presents a rundown of the industries that have been kicked in the teeth by cybercriminals amid the pandemic.

This article presents a rundown of the industries that have been kicked in the teeth by cybercriminals amid the pandemic.

Investigate, complain, and maybe sue

Investigate, complain, and maybe sue

The only valid and safe method of banking left is digital banking. As the world shuts down and we brace for our new normal, one reality still exists. We still need our money. And the way we need to access and use it now relies on digital banking more than ever.

The only valid and safe method of banking left is digital banking. As the world shuts down and we brace for our new normal, one reality still exists. We still need our money. And the way we need to access and use it now relies on digital banking more than ever.

Fintech represents the collision of two worlds — Financial services and technology, and with this union comes, both disruption and synergies. Fintech came of age in the aftermath of the 2008 financial crisis. New regulations and changing consumer demands began to emerge as the world tried to pick up the pieces of the “great recession”.

Fintech represents the collision of two worlds — Financial services and technology, and with this union comes, both disruption and synergies. Fintech came of age in the aftermath of the 2008 financial crisis. New regulations and changing consumer demands began to emerge as the world tried to pick up the pieces of the “great recession”.