Taking a closer look a crypto-currency's super star Bitcoin and its effects on the growing crypto market

The value of Bitcoin is worth more than $740 billion just behind Tesla at $758.26 billion, and digital cryptocurrency markets are worth more than $1 trillion,

The value of Bitcoin is worth more than $740 billion just behind Tesla at $758.26 billion, and digital cryptocurrency markets are worth more than $1 trillion,

Bitcoin's golden cross means nothing for the bull market. If history is our guide, bitcoin's price is slightly more likely to go down than up.

Bitcoin's golden cross means nothing for the bull market. If history is our guide, bitcoin's price is slightly more likely to go down than up.

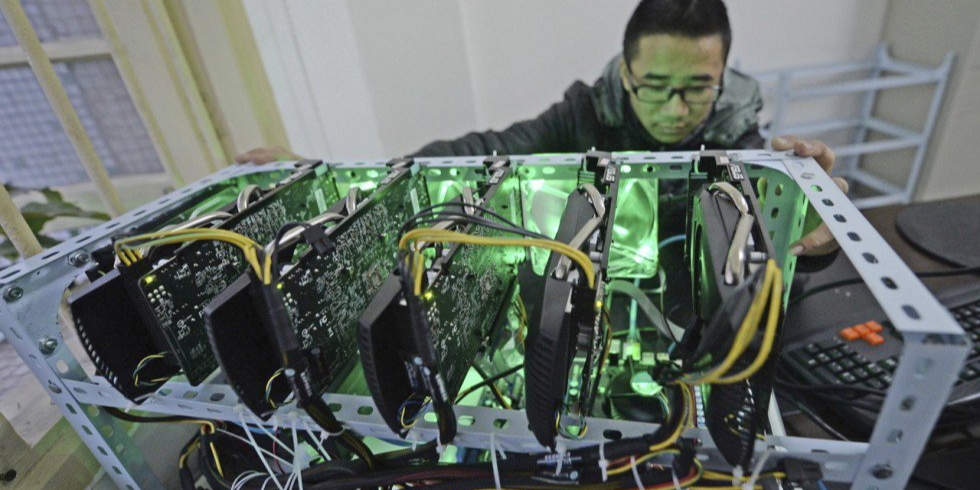

As cryptocurrencies continue to soar to new heights, investors should remember the costs of mining.

As cryptocurrencies continue to soar to new heights, investors should remember the costs of mining.

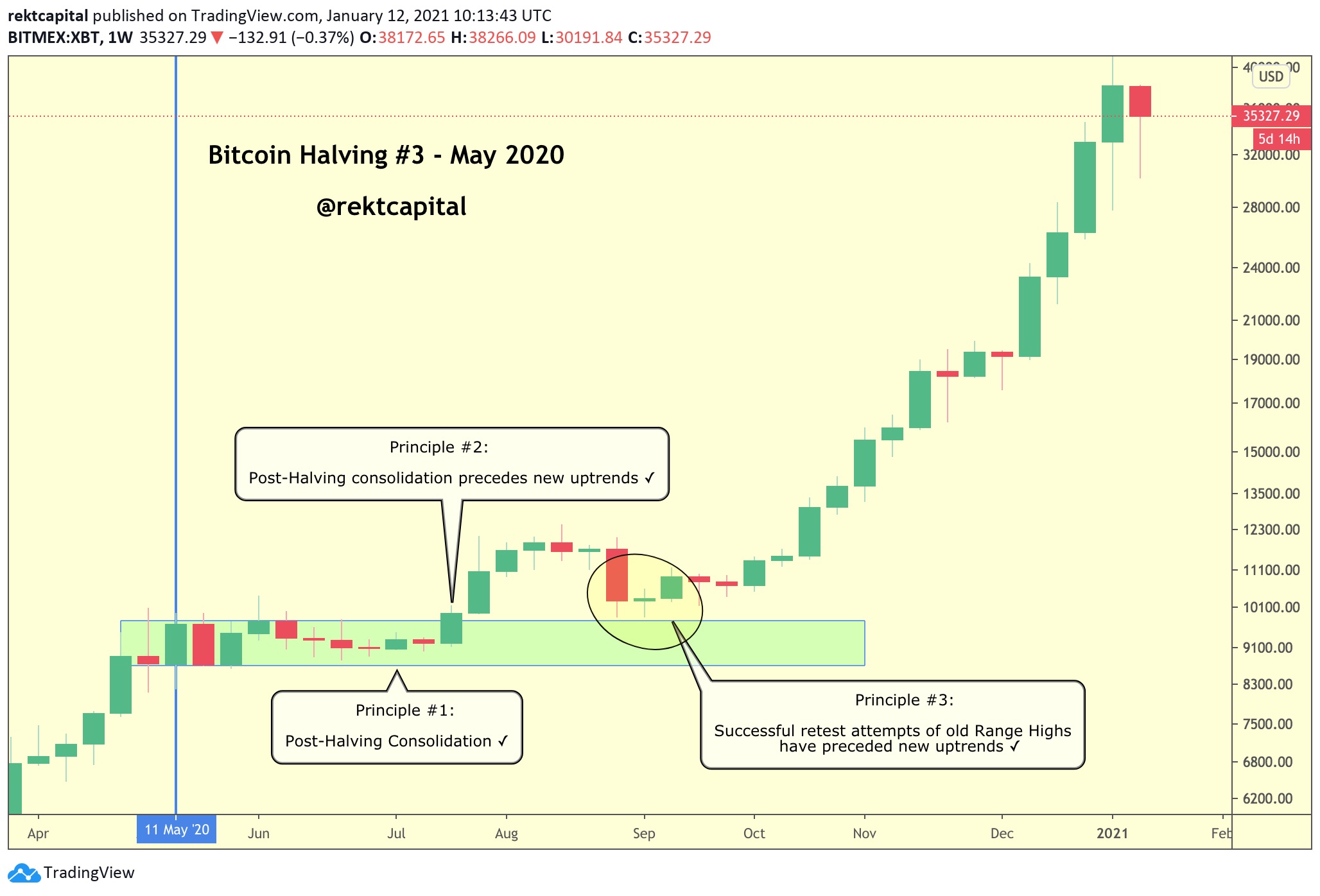

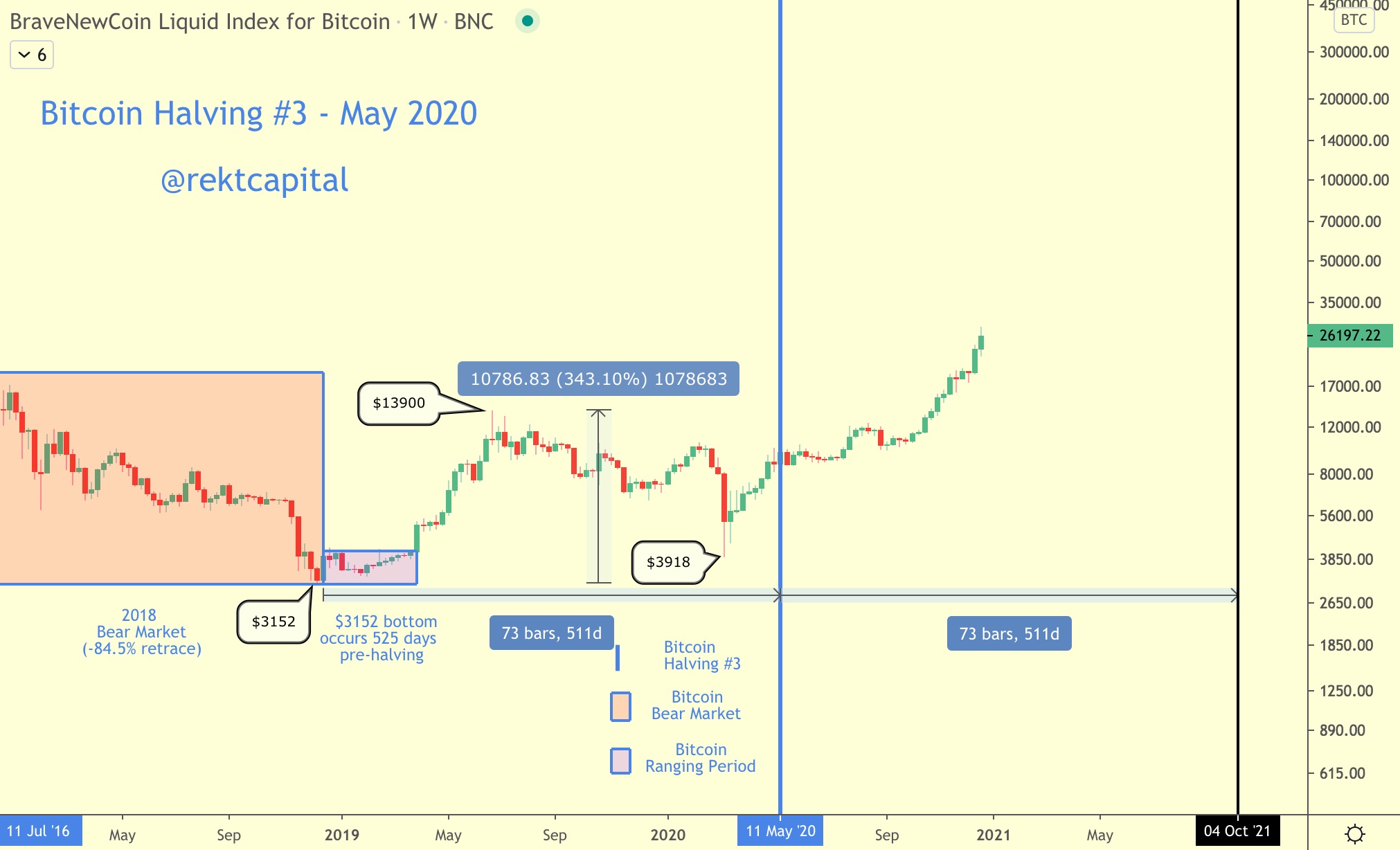

On May the 11th, Bitcoin went through its third halving in its albeit short lifetime. Whilst this event was celebrated by most in the crypto community, some bring up some valid concerns about whether or not many miners will be able to survive with their revenues effectively cut by almost 50% in a single day.

On May the 11th, Bitcoin went through its third halving in its albeit short lifetime. Whilst this event was celebrated by most in the crypto community, some bring up some valid concerns about whether or not many miners will be able to survive with their revenues effectively cut by almost 50% in a single day.

I interviewed the alleged inventor of bitcoin, Dr. Craig Wright

I interviewed the alleged inventor of bitcoin, Dr. Craig Wright

In a nutshell, governments cannot take away your Bitcoin

In a nutshell, governments cannot take away your Bitcoin

The blare of the siren slowly died down as the police began to raid an abandoned house that was surrounded by overgrown shrubs and trees in the back of beyond.

The blare of the siren slowly died down as the police began to raid an abandoned house that was surrounded by overgrown shrubs and trees in the back of beyond.

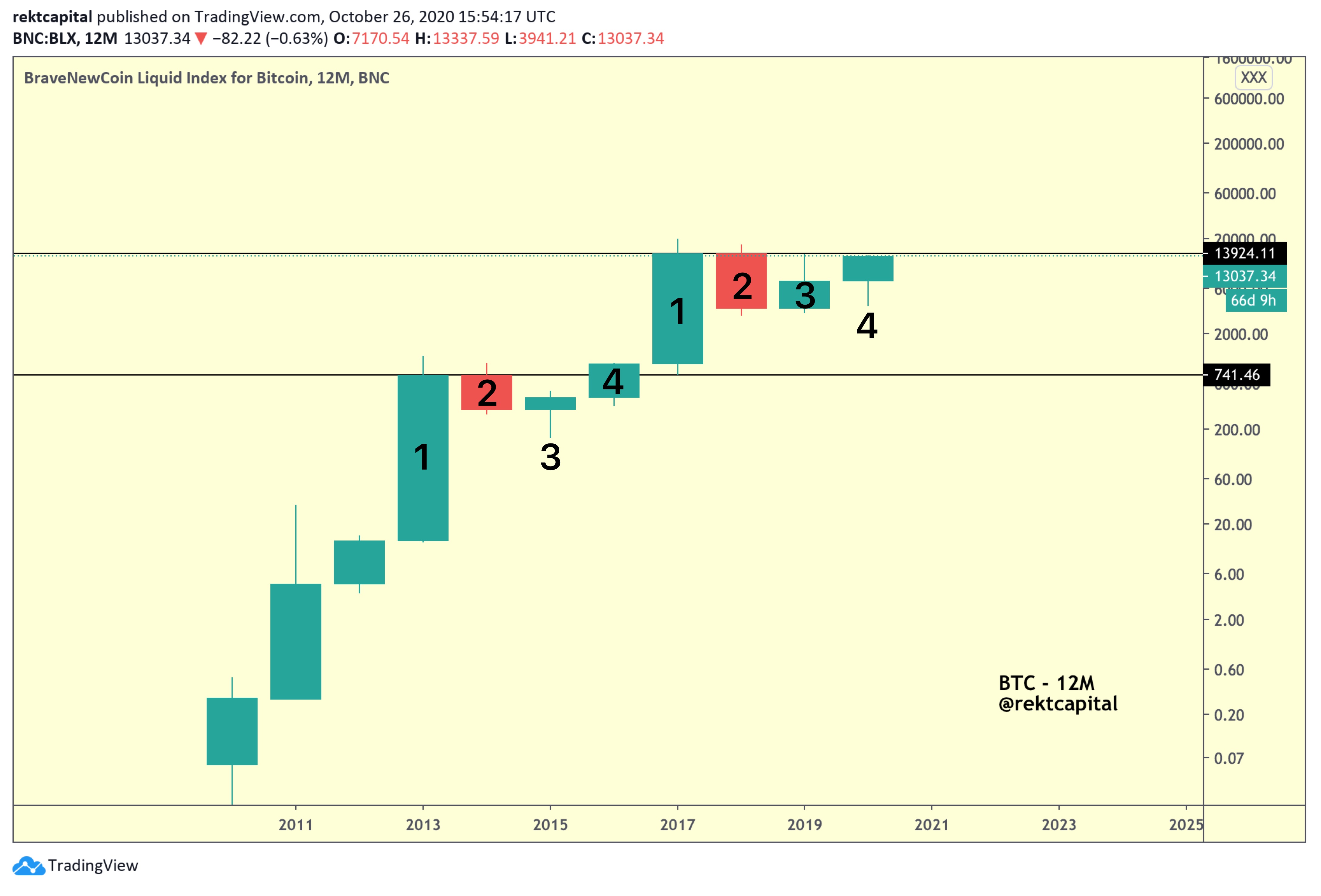

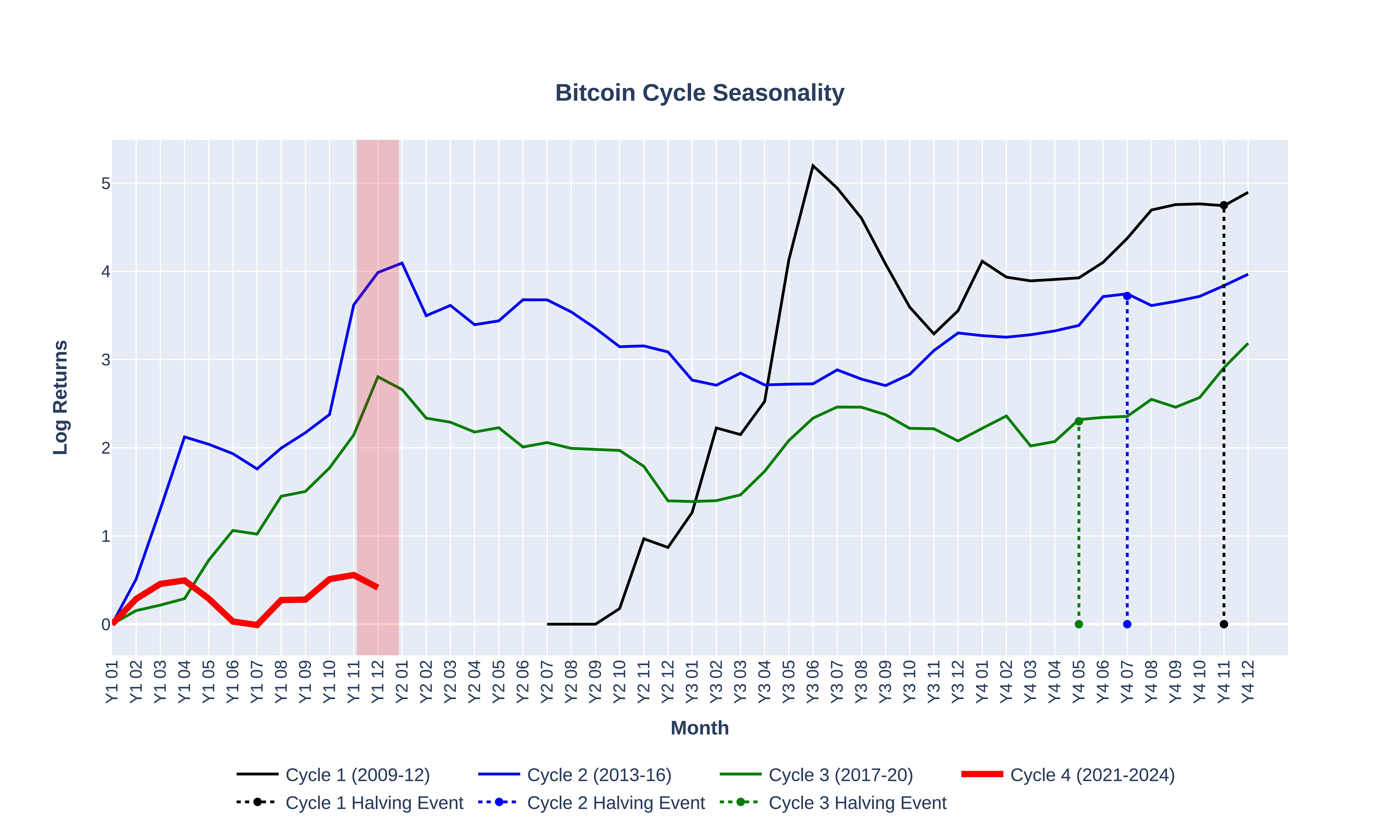

Did we front run Bitcoin seasonality? Here we analyze Bitcoin's 4-year cycle.

Did we front run Bitcoin seasonality? Here we analyze Bitcoin's 4-year cycle.

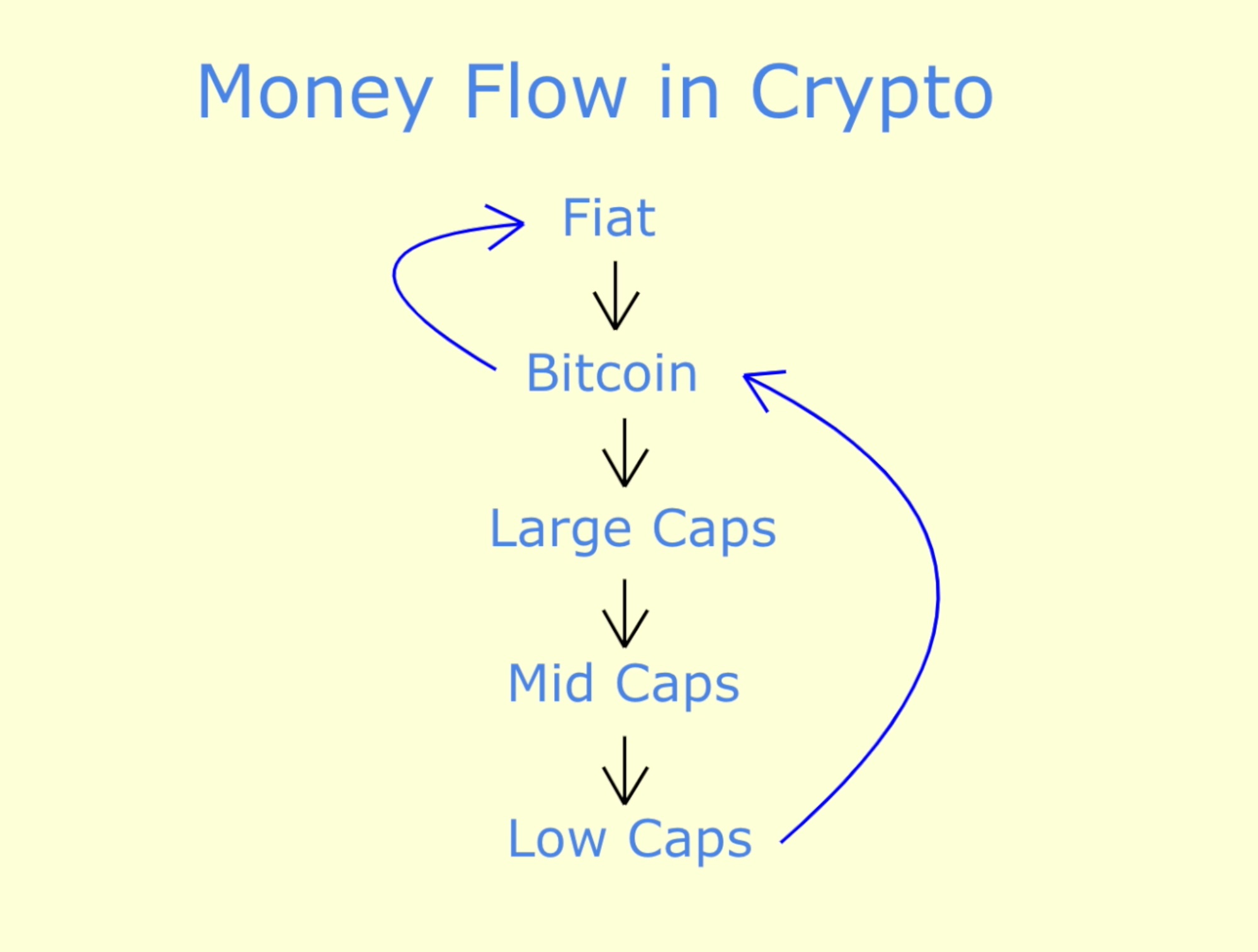

Bitcoin's price keeps going up and altseason will come soon. Altcoins could go to the moon as bitcoin explodes. Chances are, you're not ready. Change that ASAP

Bitcoin's price keeps going up and altseason will come soon. Altcoins could go to the moon as bitcoin explodes. Chances are, you're not ready. Change that ASAP

Bitcoin's price remains in a three-year parabolic uptrend, but there's not much room left to go up. Do we get a blow-off top or will the parabola break?

Bitcoin's price remains in a three-year parabolic uptrend, but there's not much room left to go up. Do we get a blow-off top or will the parabola break?

Bitcoin doesn't have ever-changing rules; it doesn’t inflate you away, it doesn’t require a third party, and no one can freeze or seize your funds.

Bitcoin doesn't have ever-changing rules; it doesn’t inflate you away, it doesn’t require a third party, and no one can freeze or seize your funds.

Pandora's box has been opened. Bitcoin has proven that decentralized tech can be used to push back against oppressive regimes. But that's not just important to monetary policy.

Pandora's box has been opened. Bitcoin has proven that decentralized tech can be used to push back against oppressive regimes. But that's not just important to monetary policy.

It may seem like you get a better deal at $35k than at $65, but most people will tell you the opposite. They're wrong.

It may seem like you get a better deal at $35k than at $65, but most people will tell you the opposite. They're wrong.

China banning crypto and Bitcoin again, but would it affect the market? Recent mining ban, crypto ban discussed and explained.

China banning crypto and Bitcoin again, but would it affect the market? Recent mining ban, crypto ban discussed and explained.

Businesses in Hong Kong Begin Accepting Bitcoin, but Could it be Risky?

Businesses in Hong Kong Begin Accepting Bitcoin, but Could it be Risky?

Today’s global political and economic climate is one of uncertainty. The period of relative calm and international cooperation, for better or worse, is at a crossroads. With the election of Trump and the emergence of Brexit, it seems nationalism and populism have returned to levels not seen since the pre-World War II era.

Today’s global political and economic climate is one of uncertainty. The period of relative calm and international cooperation, for better or worse, is at a crossroads. With the election of Trump and the emergence of Brexit, it seems nationalism and populism have returned to levels not seen since the pre-World War II era.

On December 15, two years ago, the largest American company CME Group launched Bitcoin futures .

CME is the only one who provides the opportunity to trade bitcoin futures in the United States and they are the first to enter the territory of derivatives instrument for the cryptocurrency market and now they have no competitors.

On December 15, two years ago, the largest American company CME Group launched Bitcoin futures .

CME is the only one who provides the opportunity to trade bitcoin futures in the United States and they are the first to enter the territory of derivatives instrument for the cryptocurrency market and now they have no competitors.

CME futures are one of the most manipulative instruments on the cryptocurrency market. And the opening and closing of their futures suggests when the bottom will be.

On December 15, 2017 two contracts were opened:

- 3 months until March 29: opening price $20,631 - closing price $7,070;

- 6 months until June 29: opening price $20,631 - closing price $5,800.

Bitcoin’s halving is just around the corner. It is estimated to take place on May 12th, 2020, and it will slash the reward miners get from 12.5 BTC to 6.25 BTC. Currently, the network produces 1,800 BTC every day, and this is about to be reduced to 900 BTC.

Bitcoin’s halving is just around the corner. It is estimated to take place on May 12th, 2020, and it will slash the reward miners get from 12.5 BTC to 6.25 BTC. Currently, the network produces 1,800 BTC every day, and this is about to be reduced to 900 BTC.

Bitcoin and Crypto are often understood as the same term while they are not. We miss out on the term Altcoins that back the Crypto world. Let's read about them!

Bitcoin and Crypto are often understood as the same term while they are not. We miss out on the term Altcoins that back the Crypto world. Let's read about them!

This Tweet:

This Tweet:

Sunday morning, 18.04.2021, the cryptocurrency market suddenly entered the red zone. Bitcoin and most major digital assets lost between 5% and 20% of their value overnight, leading to a massive liquidation of market positions totaling nearly $10 billion.

Sunday morning, 18.04.2021, the cryptocurrency market suddenly entered the red zone. Bitcoin and most major digital assets lost between 5% and 20% of their value overnight, leading to a massive liquidation of market positions totaling nearly $10 billion.

As a person who is very slow to technological advancements and procedures, the decision to own a bitcoin came very late but it was worth it.

As a person who is very slow to technological advancements and procedures, the decision to own a bitcoin came very late but it was worth it.

Financialization will bring new risks and will increase third party custody well above 50% of current stock. This may be a systemic risk for bitcoin.

Financialization will bring new risks and will increase third party custody well above 50% of current stock. This may be a systemic risk for bitcoin.

Will Bitcoin reach 100k USD before the end of this year? What are the predictions for the crypto market and when can we expect the market peak?

Will Bitcoin reach 100k USD before the end of this year? What are the predictions for the crypto market and when can we expect the market peak?

Bloom filters are a data structure developed by Burton Howard Bloom in 1970. You can see them as a hash tables’ cousin. They also allow for efficient insert and lookup operations while occupying very little space

Bloom filters are a data structure developed by Burton Howard Bloom in 1970. You can see them as a hash tables’ cousin. They also allow for efficient insert and lookup operations while occupying very little space

This is only a basic guide for new users who just need to get their unconfirmed transactions mined quickly, I do not cover the advanced setup requirements to use Electrum in a private way.

This is only a basic guide for new users who just need to get their unconfirmed transactions mined quickly, I do not cover the advanced setup requirements to use Electrum in a private way.

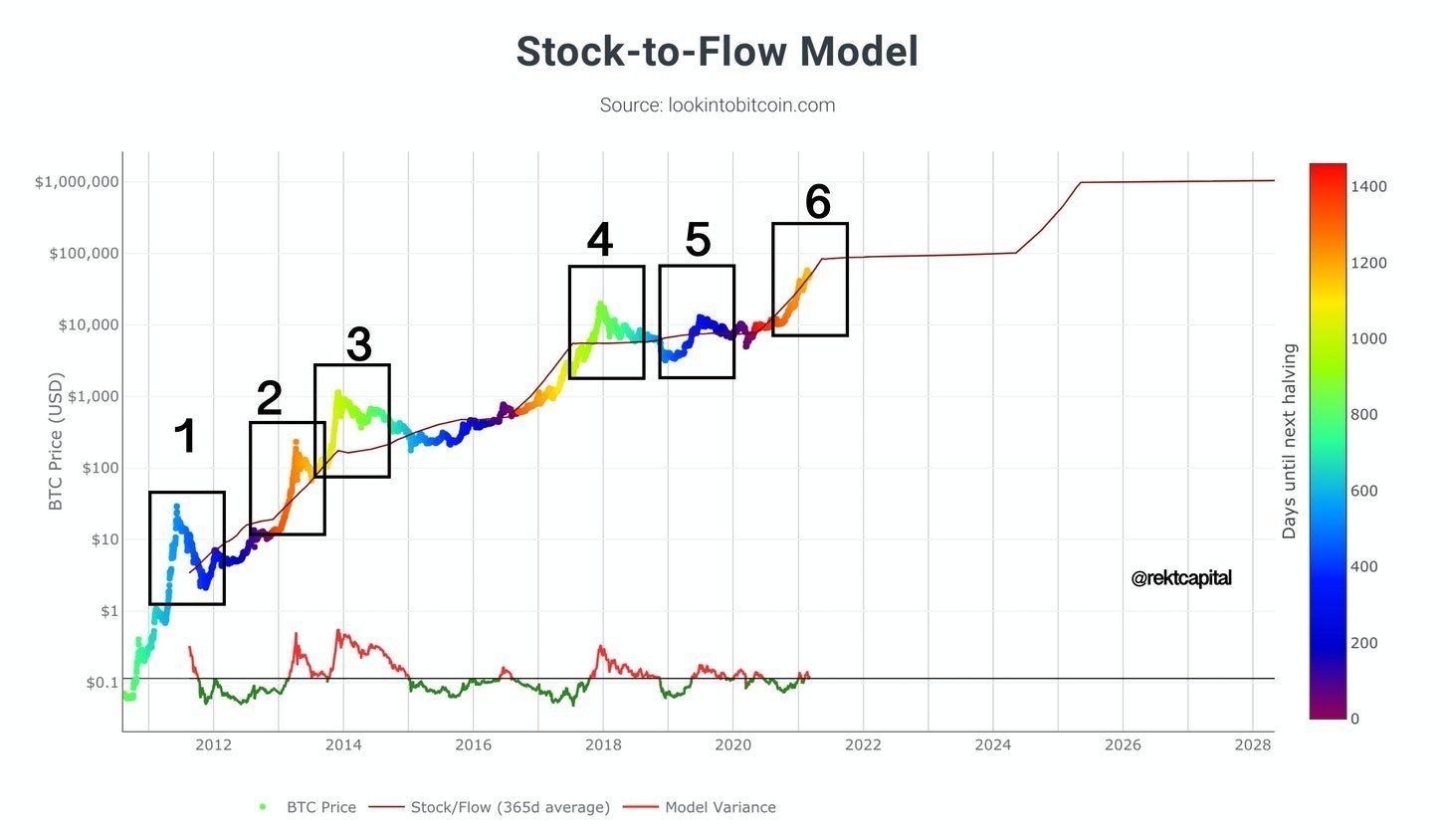

Bitcoin is poised to become the currency of the future and it is well supported technically by the concept of halving and stock-to-flow model.

Bitcoin is poised to become the currency of the future and it is well supported technically by the concept of halving and stock-to-flow model.

Bitcoin made a spectacular comeback last week and made a jump back above the magical $20.000-level which was the highest valuation point of its last cycle.

Bitcoin made a spectacular comeback last week and made a jump back above the magical $20.000-level which was the highest valuation point of its last cycle.

The IMF recently took a strong stance against crypto regulations in Argentina, warning of potential legal and financial issues. It's clear the IMF isn't keen on

The IMF recently took a strong stance against crypto regulations in Argentina, warning of potential legal and financial issues. It's clear the IMF isn't keen on

Bitcoin gave us the right and the option to have a currency and asset that is not controlled by the government but by market forces instead.

Bitcoin gave us the right and the option to have a currency and asset that is not controlled by the government but by market forces instead.

A proposal to solve the hyperinflation problem through adopting Bitcoin UBI, powered by Stacks blockchain Proof-of-transfer mechanism.

A proposal to solve the hyperinflation problem through adopting Bitcoin UBI, powered by Stacks blockchain Proof-of-transfer mechanism.

Transitioning into the new year, 2023, feels like a much-needed fresh start for cry on many accords. 2022 delivered some of the toughest conditions to remember.

Transitioning into the new year, 2023, feels like a much-needed fresh start for cry on many accords. 2022 delivered some of the toughest conditions to remember.

While some maximalists assert that altcoins are just unregistered securities, most consider them technically and morally questionable, if not outright scams.

While some maximalists assert that altcoins are just unregistered securities, most consider them technically and morally questionable, if not outright scams.

Bitcoin was created in the midst of the 2008 financial crisis, and the economic impacts of the coronavirus pandemic are setting the stage for Bitcoin’s greatest test yet.

Bitcoin was created in the midst of the 2008 financial crisis, and the economic impacts of the coronavirus pandemic are setting the stage for Bitcoin’s greatest test yet.

Being a CEO of cryptocurrency exchange Kyrrex, based in Malta, I would like to tell about the state of the Chinese mining market and the challenges that mining companies will face in the near future.

Being a CEO of cryptocurrency exchange Kyrrex, based in Malta, I would like to tell about the state of the Chinese mining market and the challenges that mining companies will face in the near future.

Three metrics tell you whether to exit or accumulate when bitcoin's price booms.

Three metrics tell you whether to exit or accumulate when bitcoin's price booms.

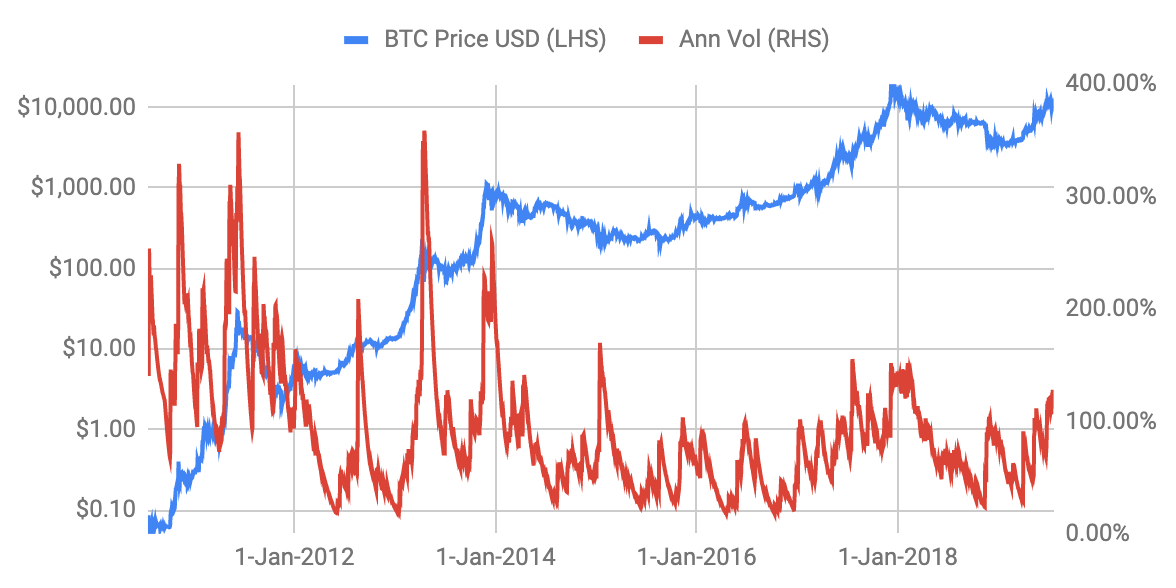

In 2019, Bitcoin's (BTC) volatility was erratic. On one day alone, the price of bitcoin changed by over 40%. However, for most days, the change in price hovers around 1%-2%. The purpose of this article is to investigate the nature of BTC's volatility and see what kind of strategies are suited best to take advantage of it.

In 2019, Bitcoin's (BTC) volatility was erratic. On one day alone, the price of bitcoin changed by over 40%. However, for most days, the change in price hovers around 1%-2%. The purpose of this article is to investigate the nature of BTC's volatility and see what kind of strategies are suited best to take advantage of it.

Bitcoin's YTD performance is up +20% along with a +287% increase since the past 6 months when institutional movement started to kick off.

Bitcoin's YTD performance is up +20% along with a +287% increase since the past 6 months when institutional movement started to kick off.

This past week, U.S. regulators issued a new cryptocurrency ruling and denied the last of the bitcoin ETF proposals.

This past week, U.S. regulators issued a new cryptocurrency ruling and denied the last of the bitcoin ETF proposals.

Bitcoin is the top crypto asset in the cryptocurrency market but most crypto enthusiasts would argue that it does not deserve the spot and Satoshi might agree.

Bitcoin is the top crypto asset in the cryptocurrency market but most crypto enthusiasts would argue that it does not deserve the spot and Satoshi might agree.

A quick revision of Satoshi's vision for a decentralized financial system.

A quick revision of Satoshi's vision for a decentralized financial system.

The first time we all heard of Blockchain many years ago probably didn't hint at the potential that the cryptocurrency has shown to demonstrate in recent years

The first time we all heard of Blockchain many years ago probably didn't hint at the potential that the cryptocurrency has shown to demonstrate in recent years

The decentralized, permissionless nature of Bitcoin really does make it a beast that cannot be brought down that easily. This is a crucial aspect of Bitcoin as

The decentralized, permissionless nature of Bitcoin really does make it a beast that cannot be brought down that easily. This is a crucial aspect of Bitcoin as

Bitcoin restores power equilibrium, taking it from tyrants and giving it to the meek who shall inherit the earth

Bitcoin restores power equilibrium, taking it from tyrants and giving it to the meek who shall inherit the earth

To delve deeper into this subject and understand how it can be achieved, I reached out to Diego Gutierrez, the co-founder of RSK.

To delve deeper into this subject and understand how it can be achieved, I reached out to Diego Gutierrez, the co-founder of RSK.

(An analysis of bitcoin strategies for oil rich and sanctioned countries)

(An analysis of bitcoin strategies for oil rich and sanctioned countries)

What steps should El Salvador take to further bitcoinization and foster its economic development. Saylor and Tudor Jones: start lobbying for Bitcoin

What steps should El Salvador take to further bitcoinization and foster its economic development. Saylor and Tudor Jones: start lobbying for Bitcoin

Bitcoin becomes an official currency of El Salvador and automatically becomes a foreign currency worldwide, why El Salvadorian people protesting?

Bitcoin becomes an official currency of El Salvador and automatically becomes a foreign currency worldwide, why El Salvadorian people protesting?

Major mainstream media made a coordinated attack on Bitcoin’s energy consumption.

Major mainstream media made a coordinated attack on Bitcoin’s energy consumption.

In December 2020, the Securities and Exchange Commission (SEC) filed a lawsuit against Ripple, leading to a chain of events that threatens XRP and Bitcoin.

In December 2020, the Securities and Exchange Commission (SEC) filed a lawsuit against Ripple, leading to a chain of events that threatens XRP and Bitcoin.

This week's "crypto crash" is more of an "everything crash", and no cause for alarm. Check out the surrounding context and do not fall for media scaremongers

This week's "crypto crash" is more of an "everything crash", and no cause for alarm. Check out the surrounding context and do not fall for media scaremongers

How would you feel if you got a 50 percent pay cut? What if you knew exactly when it was going to happen in advance, and there was still nothing you could do to stop it?

How would you feel if you got a 50 percent pay cut? What if you knew exactly when it was going to happen in advance, and there was still nothing you could do to stop it?

Thought you knew everything about Bitcoin? This article will introduce you to 8 totally unknown facts about the king of digital currency.

Thought you knew everything about Bitcoin? This article will introduce you to 8 totally unknown facts about the king of digital currency.

The purpose of Taproot is to improve the usability and privacy of cryptocurrencies, and at lower transaction costs. Let's breathe new life into Bitcoin.

The purpose of Taproot is to improve the usability and privacy of cryptocurrencies, and at lower transaction costs. Let's breathe new life into Bitcoin.

Several high-profile challenges to Bitcoin itself with the aim of improving its limitations have failed due to one reason.

Several high-profile challenges to Bitcoin itself with the aim of improving its limitations have failed due to one reason.

Deemed as one of the biggest potential technological revolutions of recent history, quantum computing also poses security risks for the cryptocurrency space. Quantum-computing is able to harness quantum mechanics to reach data processing levels otherwise impossible with traditional computing.

Deemed as one of the biggest potential technological revolutions of recent history, quantum computing also poses security risks for the cryptocurrency space. Quantum-computing is able to harness quantum mechanics to reach data processing levels otherwise impossible with traditional computing.

How investors and custody's perception towards bitcoin changed in 2020

How investors and custody's perception towards bitcoin changed in 2020

Bitcoin — the king of cryptocurrencies — uses the Proof of Work POW consensus algorithm to secure its network.

Bitcoin — the king of cryptocurrencies — uses the Proof of Work POW consensus algorithm to secure its network.

20 reasons not to buy bitcoin. Investing isn't for everyone. Bitcoin has a way of humbling everyone who gets involved with i.t

20 reasons not to buy bitcoin. Investing isn't for everyone. Bitcoin has a way of humbling everyone who gets involved with i.t

Foreword: You may not be aware — particularly if you live in the United States— but the global economy is now entering uncharted territory as negative interest rates become reality in Europe and elsewhere. Suddenly the financial media (sponsored in no small measure by global banks) are working overtime to ‘educate’ the masses as to why the practice of paying your bank to hold your cash makes perfect sense. (They conveniently forget to mention that they will immediately lend your money to other customers, but good luck getting negative rates as a borrower!)

Foreword: You may not be aware — particularly if you live in the United States— but the global economy is now entering uncharted territory as negative interest rates become reality in Europe and elsewhere. Suddenly the financial media (sponsored in no small measure by global banks) are working overtime to ‘educate’ the masses as to why the practice of paying your bank to hold your cash makes perfect sense. (They conveniently forget to mention that they will immediately lend your money to other customers, but good luck getting negative rates as a borrower!)

Bitcoin Investors Are The Biggest Winners During InflationI believe there can only be one definition of inflation, and that is the one headlined by the Nobel Prize-winning economist, Milton Friedman:

Bitcoin Investors Are The Biggest Winners During InflationI believe there can only be one definition of inflation, and that is the one headlined by the Nobel Prize-winning economist, Milton Friedman:

Understanding bitcoin's Double Spending on block 666833 and whether it means that bitcoin that is not that secure after all

Understanding bitcoin's Double Spending on block 666833 and whether it means that bitcoin that is not that secure after all

Crashes are to the markets what waves are to the ocean.

Crashes are to the markets what waves are to the ocean.

Here are three reasons why Bitcoin is so volatile.

Here are three reasons why Bitcoin is so volatile.

I spent a year and $10,000 on Bitcoin so you don't have to before I stopped.

Here’s what I learned about buying crypto and Bitcoin living up to the hype.

I spent a year and $10,000 on Bitcoin so you don't have to before I stopped.

Here’s what I learned about buying crypto and Bitcoin living up to the hype.

It's a common question in a growing business: How do you scale without breaking your business model and preserving the essence and quality of what you do?

It's a common question in a growing business: How do you scale without breaking your business model and preserving the essence and quality of what you do?

The novel coronavirus might not be the world’s first pandemic or even the deadliest. But the virus has set the stage for a truly unprecedented time of global harmony.

The novel coronavirus might not be the world’s first pandemic or even the deadliest. But the virus has set the stage for a truly unprecedented time of global harmony.

One of my colleagues recently shared an anecdote with me about ‘The Simpsons.’ During a chat about politics, her son told her, “Well, it was on ‘The Simpsons’ and then it came true.” And then he asked her, “How do they do that?”

One of my colleagues recently shared an anecdote with me about ‘The Simpsons.’ During a chat about politics, her son told her, “Well, it was on ‘The Simpsons’ and then it came true.” And then he asked her, “How do they do that?”

Bright points, potential pitfalls and what you can look out for

Bright points, potential pitfalls and what you can look out for

The 8 Factors That Influence the Price of Bitcoin Downwards That You Should Know About. An important reminder.

The 8 Factors That Influence the Price of Bitcoin Downwards That You Should Know About. An important reminder.

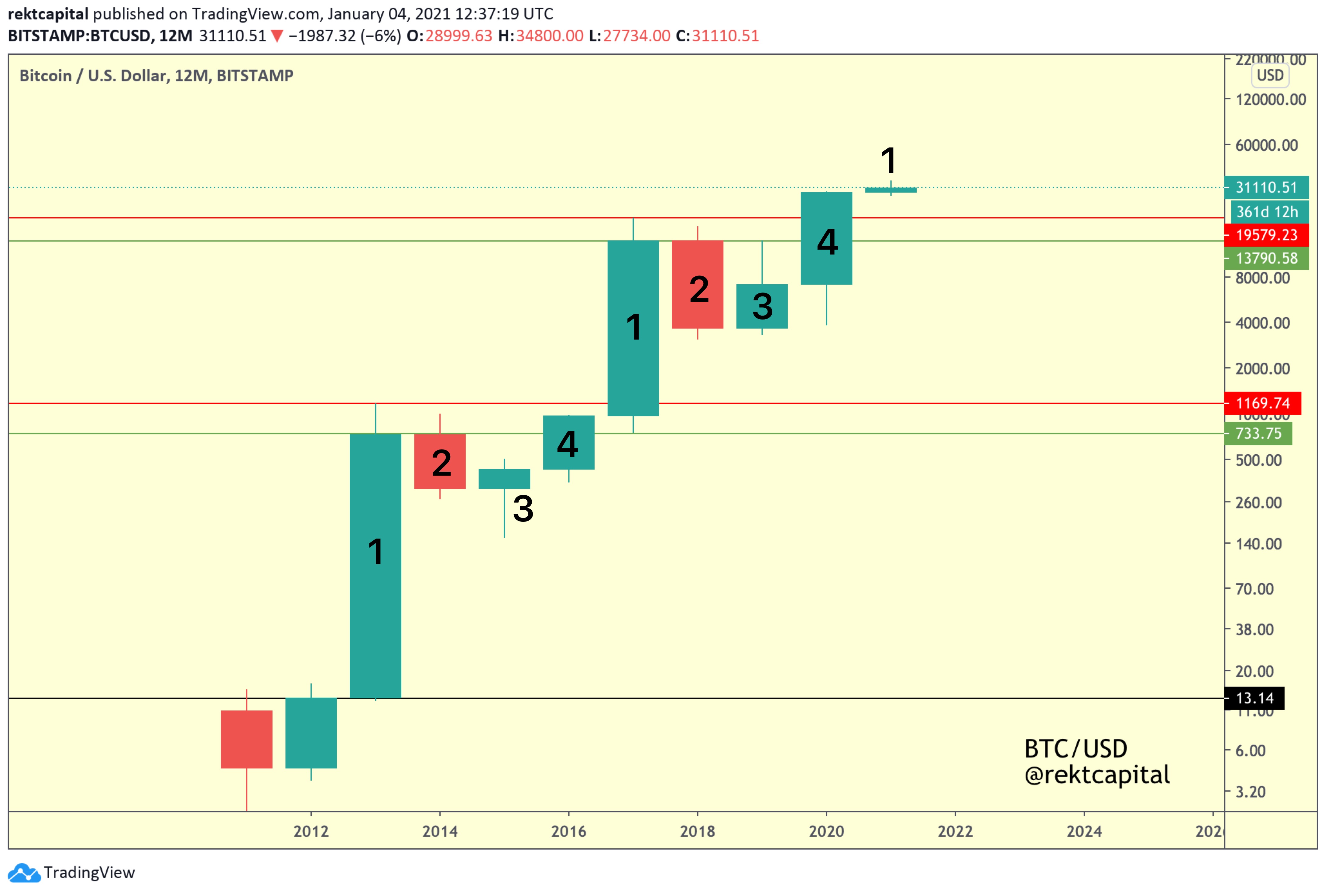

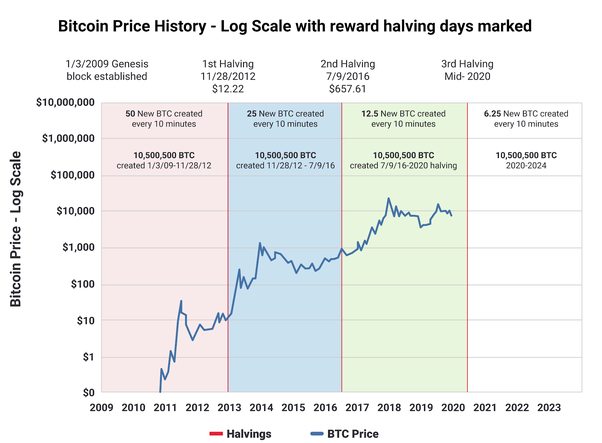

Bitcoin is booming. Just recently Elon Musk announced via a SEC filing that he put 10% of Tesla’s balance sheet into Bitcoin. However, every time there is a big drop people are scared that the end is near and that Bitcoin goes again down 80-90% like it did in 2018.. or 2014… or 2013. You see where I am getting there – Bitcoin often does that. Hence, we have market cycles and this article will look over previous market cycles in Bitcoin and where Bitcoin stands today.

Bitcoin is booming. Just recently Elon Musk announced via a SEC filing that he put 10% of Tesla’s balance sheet into Bitcoin. However, every time there is a big drop people are scared that the end is near and that Bitcoin goes again down 80-90% like it did in 2018.. or 2014… or 2013. You see where I am getting there – Bitcoin often does that. Hence, we have market cycles and this article will look over previous market cycles in Bitcoin and where Bitcoin stands today.

Scaling is one of the most talked-about things when it comes to blockchain, its the endless battle of trying to balance security, speed, and storage.

Scaling is one of the most talked-about things when it comes to blockchain, its the endless battle of trying to balance security, speed, and storage.

View all Bitcoin transactions live: https://app.flipsidecrypto.com/cooperative/bitcoin

View all Bitcoin transactions live: https://app.flipsidecrypto.com/cooperative/bitcoin

During the creation of the Bitcoin blockchain, Satoshi Nakamoto may don't have the proper technology/resources or vision that's why he created a blockchain that grows with every transaction and now it is 285.06 gigabytes!

During the creation of the Bitcoin blockchain, Satoshi Nakamoto may don't have the proper technology/resources or vision that's why he created a blockchain that grows with every transaction and now it is 285.06 gigabytes!

You spent most of 2021 waiting for the price to go up before you bought. As a result, your portfolio is down. How long do you want to repeat that pattern?

You spent most of 2021 waiting for the price to go up before you bought. As a result, your portfolio is down. How long do you want to repeat that pattern?

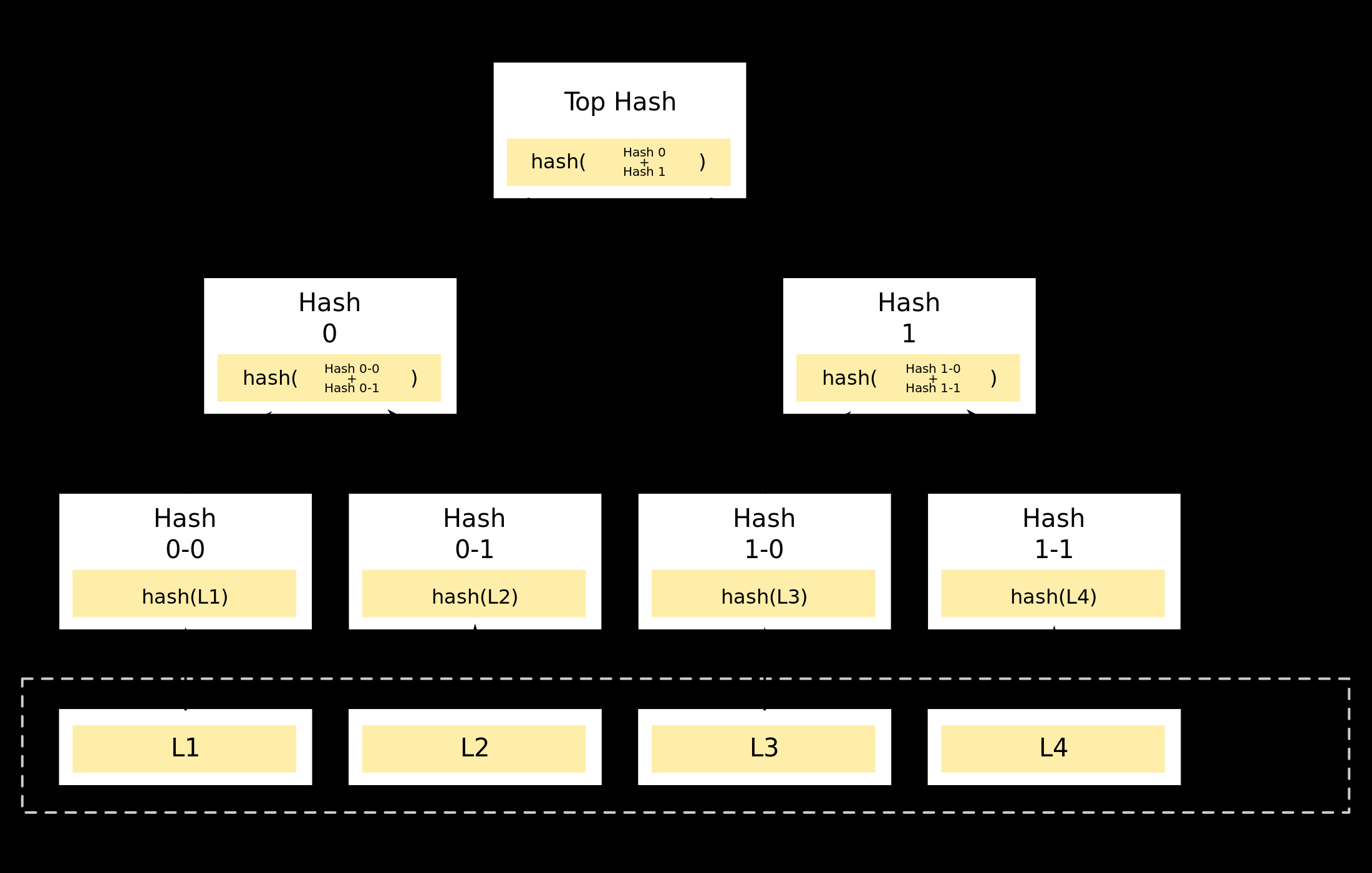

If you are going to work on a software using Bitcoin, there are several concepts you need to be familiar with.

If you are going to work on a software using Bitcoin, there are several concepts you need to be familiar with.

It’s time to build DeFi money lego on the Bitcoin ecosystem.

It’s time to build DeFi money lego on the Bitcoin ecosystem.

Over the last few months, we have seen major growth of interest in Bitcoin. Tesla, Mastercard, Visa, PayPal, Apple Pay, Uber, Amazon, General Motors, Twitter, and Oracle – all of them began talking about crypto integration as a payment method.

Over the last few months, we have seen major growth of interest in Bitcoin. Tesla, Mastercard, Visa, PayPal, Apple Pay, Uber, Amazon, General Motors, Twitter, and Oracle – all of them began talking about crypto integration as a payment method.

Bitcoin's price has nothing to do with its value or the opportunity it presents

Bitcoin's price has nothing to do with its value or the opportunity it presents

PayPal’s user base could generate demand for over 15% of Bitcoin’s current market cap over the next 12 months.

PayPal’s user base could generate demand for over 15% of Bitcoin’s current market cap over the next 12 months.

Discounting is the single most important concept in finance and possibly economics. It’s the idea that money (cash) is less valuable tomorrow than today. The reason is quite existential: our impending death.

Discounting is the single most important concept in finance and possibly economics. It’s the idea that money (cash) is less valuable tomorrow than today. The reason is quite existential: our impending death.

At this point, Bitcoin has proven itself to be an investment that can withstand some troubling times.

At this point, Bitcoin has proven itself to be an investment that can withstand some troubling times.

This is part 1 of the long-term analysis of the bitcoin price chart based on the technical perspective provided by the Elliott Wave Principle (EWP). This article is an introduction to EWP while part 2 will apply the principle for price and date targets.

This is part 1 of the long-term analysis of the bitcoin price chart based on the technical perspective provided by the Elliott Wave Principle (EWP). This article is an introduction to EWP while part 2 will apply the principle for price and date targets.

You may have heard that very soon there will be a Bitcoin halving event, and that it may or may not affect the price of Bitcoin, but you’re not sure why? This guide will cover what the halving is, what block rewards are and why this might affect the future price of Bitcoin.

You may have heard that very soon there will be a Bitcoin halving event, and that it may or may not affect the price of Bitcoin, but you’re not sure why? This guide will cover what the halving is, what block rewards are and why this might affect the future price of Bitcoin.

How do the rich get richer? At the poker table, it's simple, when you have more chips, you have earned the right to lie more often.

How do the rich get richer? At the poker table, it's simple, when you have more chips, you have earned the right to lie more often.

Chainalysis' Chief Economist shares insights into Bitcoin as a maturing asset.

Chainalysis' Chief Economist shares insights into Bitcoin as a maturing asset.

Bitcoin repeats its price movements after every Halving. History repeats itself.

Bitcoin repeats its price movements after every Halving. History repeats itself.

Bitcoin tends to form Four Year Cycles. In its first year of the cycle, exponential growth occurs. In the second year - a Bear Market takes place...

Bitcoin tends to form Four Year Cycles. In its first year of the cycle, exponential growth occurs. In the second year - a Bear Market takes place...

As the Bitcoin block reward halving draws near, the expectations seem to intensify as well. Previous halvings have yielded a significant increase in Bitcoin's value, after all.

As the Bitcoin block reward halving draws near, the expectations seem to intensify as well. Previous halvings have yielded a significant increase in Bitcoin's value, after all.

The biggest Bitcoin event will approximately take place on May 11, in just a week from now. If you are not familiar with the Halving, it simply means that the block reward for Bitcoin will decrease from 12.5 coins per block to 6.25 coins per block, half.

The biggest Bitcoin event will approximately take place on May 11, in just a week from now. If you are not familiar with the Halving, it simply means that the block reward for Bitcoin will decrease from 12.5 coins per block to 6.25 coins per block, half.

As any fan of cryptocurrencies can tell you, the total number of Bitcoin is programmed to be limited to 21 million. Now, this may not seem like much for a cryptocurrency supposed, one day, to replace the dollar, so where does this number come from? When will it be reached? And what is all this talk about a ‘halving’?

As any fan of cryptocurrencies can tell you, the total number of Bitcoin is programmed to be limited to 21 million. Now, this may not seem like much for a cryptocurrency supposed, one day, to replace the dollar, so where does this number come from? When will it be reached? And what is all this talk about a ‘halving’?

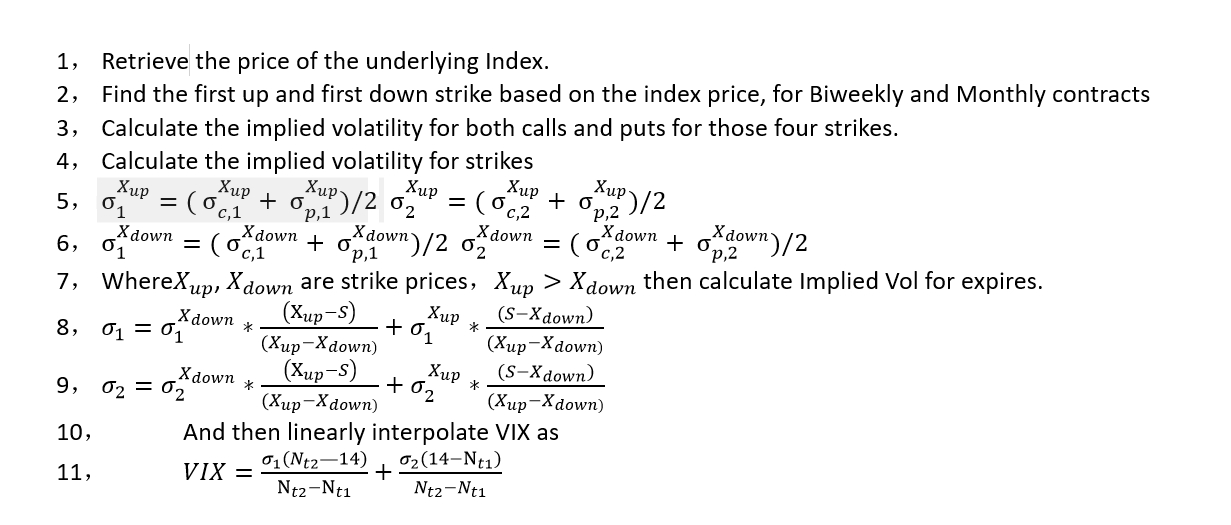

A volatility index or VIX, is used to measure the expected volatility of the underlying within a timeframe in the future, there are at least two ways of calculating implied future volatility, the most widely used method is the one employed by CBOE’s VIX calculation, the one which is “modeless”.

A volatility index or VIX, is used to measure the expected volatility of the underlying within a timeframe in the future, there are at least two ways of calculating implied future volatility, the most widely used method is the one employed by CBOE’s VIX calculation, the one which is “modeless”.

Many numbers get floated on where Bitcoin is eventuallyheading. While I agree with many of them, I think we can draw some actualreasoning to price surges that will come with time.

Many numbers get floated on where Bitcoin is eventuallyheading. While I agree with many of them, I think we can draw some actualreasoning to price surges that will come with time.

Part 1 of this series of analysis articles introduced Elliott Wave Principle (EWP). The core assumption is counter-intuitive, at first:

Part 1 of this series of analysis articles introduced Elliott Wave Principle (EWP). The core assumption is counter-intuitive, at first:

"The Wave Principle argues that markets are not driven by fundamentals or news, but instead by “social mood” – the collective psychology of all market participants"

Bitcoin has rallied over 300% since its bottom in mid-December 2018.

Bitcoin has rallied over 300% since its bottom in mid-December 2018.

"In a few decades when the reward gets too small, the transaction fee will become the main compensation for nodes. I'm sure that in 20 years there will either be very large transaction volume or no volume."-Satoshi Nakamoto in 2010

"In a few decades when the reward gets too small, the transaction fee will become the main compensation for nodes. I'm sure that in 20 years there will either be very large transaction volume or no volume."-Satoshi Nakamoto in 2010

Two decades ago, Nobel Prize-wining economist Milton Friedman said:

Two decades ago, Nobel Prize-wining economist Milton Friedman said:

A couple of years into crypto…

A couple of years into crypto…

The cryptocurrency space has grown in leaps and bounds since the introduction of bitcoin in 2009. The year 2021, apart from being the beginning of a new decade,

The cryptocurrency space has grown in leaps and bounds since the introduction of bitcoin in 2009. The year 2021, apart from being the beginning of a new decade,

Bitcoin's recent price surge ensured the cryptocurrency reached an all-time high, breaking beyond the $66,000 barrier for the first time. What should we expect?

Bitcoin's recent price surge ensured the cryptocurrency reached an all-time high, breaking beyond the $66,000 barrier for the first time. What should we expect?

Bitcoin's price tends to increase due to the Bitcoin Halving. So how much could Bitcoin's price increase as a result of the recent Halving In May 2020?

Bitcoin's price tends to increase due to the Bitcoin Halving. So how much could Bitcoin's price increase as a result of the recent Halving In May 2020?

Today Luke Asks:

Today Luke Asks:

Simple Payment Verification, usually abbreviated to SPV, is a system outlined in the original Bitcoin Whitepaper that enables light clients (wallets running on low-end systems) to verify that a transaction has been included in Bitcoin and therefore a payment has been made.

Simple Payment Verification, usually abbreviated to SPV, is a system outlined in the original Bitcoin Whitepaper that enables light clients (wallets running on low-end systems) to verify that a transaction has been included in Bitcoin and therefore a payment has been made.

The popular and most successful cryptocurrency to date, Bitcoin, has continued to gain prominence. Putting it in this perspective; it took just 10 out of its 11 years of creation for the President of the United States, Chairman of the Federal Reserve, Congress, Senate, and even the IMF to give a public statement on Bitcoin. Why is Bitcoin getting this attention?. This article covers a brief history, the philosophy behind Bitcoins’ creation and the role it plays now and in the distant future.

The popular and most successful cryptocurrency to date, Bitcoin, has continued to gain prominence. Putting it in this perspective; it took just 10 out of its 11 years of creation for the President of the United States, Chairman of the Federal Reserve, Congress, Senate, and even the IMF to give a public statement on Bitcoin. Why is Bitcoin getting this attention?. This article covers a brief history, the philosophy behind Bitcoins’ creation and the role it plays now and in the distant future.

The Bitcoin Blockchain is overvalued because it is inefficient, has a price that is extremely volatile, and is becoming more centralized as time passes.

The Bitcoin Blockchain is overvalued because it is inefficient, has a price that is extremely volatile, and is becoming more centralized as time passes.

This year, sometime around mid-May, an event long anticipated in the Bitcoin community will occur: halving, i.e. the reward granted to miners per block added to the already existing blockchain (from 12.5 BTC to 6.25 BTC) will be halved. The history of Bitcoin will see 32 halvings, and we are approaching merely the third one. Very many people continue to wonder about the impact of this halving, about the evolution of the price, about what will happen with the miners, etc.

This year, sometime around mid-May, an event long anticipated in the Bitcoin community will occur: halving, i.e. the reward granted to miners per block added to the already existing blockchain (from 12.5 BTC to 6.25 BTC) will be halved. The history of Bitcoin will see 32 halvings, and we are approaching merely the third one. Very many people continue to wonder about the impact of this halving, about the evolution of the price, about what will happen with the miners, etc.

There are several reasons why the world is talking about retailers accepting Bitcoin in the first place. Firstly, there are millions of crypto holders worldwide with over 42 million blockchain wallets. In some countries, the number of people who own crypto reach up to 25% of the population. Secondly, the transactions are fast and secure. Thirdly, the transactions are cheap.

There are several reasons why the world is talking about retailers accepting Bitcoin in the first place. Firstly, there are millions of crypto holders worldwide with over 42 million blockchain wallets. In some countries, the number of people who own crypto reach up to 25% of the population. Secondly, the transactions are fast and secure. Thirdly, the transactions are cheap.

Hey!,

Hey!,

Institutional investment was one of the top talking points for the crypto space in 2020. It was quite understandable, with companies looking to stay positive on their balance sheets and make gains with Bitcoin.

Institutional investment was one of the top talking points for the crypto space in 2020. It was quite understandable, with companies looking to stay positive on their balance sheets and make gains with Bitcoin.

You’ve probably noticed a meme that’s gone around the cryptosphere for the last few years.

You’ve probably noticed a meme that’s gone around the cryptosphere for the last few years.

Bitcoin and Ethereum differ in many ways. In this article, I will cover one of their differences: the way they keep track of what coins a user owns.

Bitcoin and Ethereum differ in many ways. In this article, I will cover one of their differences: the way they keep track of what coins a user owns.

Why Bitcoin Is Likely to Be Worth Over $100,000.

Why Bitcoin Is Likely to Be Worth Over $100,000.

An interview with a Tongan Noble and member of parliament working to help Tongans adopt Bitcoin.

An interview with a Tongan Noble and member of parliament working to help Tongans adopt Bitcoin.

Expecting a year-long bitcoin supercycle that never ends? You might want to see this.

Expecting a year-long bitcoin supercycle that never ends? You might want to see this.

What is Mining:

What is Mining:

With bitcoin’s price gaining steam, you may think it’s about to go mainstream.

With bitcoin’s price gaining steam, you may think it’s about to go mainstream.

"Many of the things you can count, don't count. Many of the things you can't count, really count." - Albert Einstein

"Many of the things you can count, don't count. Many of the things you can't count, really count." - Albert Einstein

Invariably, as bitcoin spikes and defies gravity, either up or down, the attention of institutional investors, central bankers and prominent financiers is suddenly awaken.

Invariably, as bitcoin spikes and defies gravity, either up or down, the attention of institutional investors, central bankers and prominent financiers is suddenly awaken.

The following are not my beliefs, but a compilation of notes from conversations I had with a self-described Bitcoin “mutant”, named Edan Yago, contributor to Sovryn. Letting him ramble on about Bitcoin resulted in mesmerizing, mythical, and fascinating ruminations about Bitcoin’s destiny. So for one, I myself believe in Bitcoin as a digital store of value. It is a huge chunk of my portfolio, and I believe it will outlast 99% of the cryptocurrencies we have today. There is no better symbol of scarcity and hard money in crypto to date. However, I feel just about the same level of admiration for Ethereum, as it is opening up so many use cases through DeFi and DAOs. I am putting my biases aside to explain a very rare (and what I find fascinating) point of view. I present you Part 1 of The Hero’s Journey of Bitcoin:

The following are not my beliefs, but a compilation of notes from conversations I had with a self-described Bitcoin “mutant”, named Edan Yago, contributor to Sovryn. Letting him ramble on about Bitcoin resulted in mesmerizing, mythical, and fascinating ruminations about Bitcoin’s destiny. So for one, I myself believe in Bitcoin as a digital store of value. It is a huge chunk of my portfolio, and I believe it will outlast 99% of the cryptocurrencies we have today. There is no better symbol of scarcity and hard money in crypto to date. However, I feel just about the same level of admiration for Ethereum, as it is opening up so many use cases through DeFi and DAOs. I am putting my biases aside to explain a very rare (and what I find fascinating) point of view. I present you Part 1 of The Hero’s Journey of Bitcoin:

Given the amount of hype around Bitcoin, one would think this MYTH of a 21 million coin cap would get more attention. Bitcoin's supply is capped at 21 million

Given the amount of hype around Bitcoin, one would think this MYTH of a 21 million coin cap would get more attention. Bitcoin's supply is capped at 21 million

This guide's selection of bitcoin mining equipment adheres to the most secure cryptographic procedures to keep your cryptocurrency secure.

This guide's selection of bitcoin mining equipment adheres to the most secure cryptographic procedures to keep your cryptocurrency secure.

The following article aims to rewrite Bitcoin’s original paper from a common man’s view. It may not be the most technically correct version. The purpose of this is to simplify Bitcoin for people who have a basic understanding of finance and little technical knowledge.

The following article aims to rewrite Bitcoin’s original paper from a common man’s view. It may not be the most technically correct version. The purpose of this is to simplify Bitcoin for people who have a basic understanding of finance and little technical knowledge.

by Psychedelic Bart

by Psychedelic Bart

the majority of digital coins on the market are issued by private blockchain corporations, there are several factors that count towards the value of crypto

the majority of digital coins on the market are issued by private blockchain corporations, there are several factors that count towards the value of crypto

Bitcoin is a transparent asset traded by Wall Street, not a medium of exchange. A currency must be private by default, Pirate Chain and Monero are great options

Bitcoin is a transparent asset traded by Wall Street, not a medium of exchange. A currency must be private by default, Pirate Chain and Monero are great options

Banks are profoundly underestimating how big this will be.

Banks are profoundly underestimating how big this will be.

According to social media, Coronavirus-related money-printing will send bitcoin’s price to the moon. “BRRRR” go the machines, they say. The BRRRR meme is strong, but this financial panic will take a while to play out, with uncertain consequences for all of us. I would not bet on inflation, though we may get it.

According to social media, Coronavirus-related money-printing will send bitcoin’s price to the moon. “BRRRR” go the machines, they say. The BRRRR meme is strong, but this financial panic will take a while to play out, with uncertain consequences for all of us. I would not bet on inflation, though we may get it.

Bitcoin mining difficulty is currently at an all-time high.

Bitcoin mining difficulty is currently at an all-time high.

During the month of August, many investors were excited to see Bitcoin shatter past the $12,000 barrier, but it was unable to hold steady after hitting a high of $12,482.20 on August 16th.

During the month of August, many investors were excited to see Bitcoin shatter past the $12,000 barrier, but it was unable to hold steady after hitting a high of $12,482.20 on August 16th.

The US dollar is losing trust, a key feature required for the cornerstone of the global financial system.

The US dollar is losing trust, a key feature required for the cornerstone of the global financial system.

It is the year of the Lord of 2009.

It is the year of the Lord of 2009.

Name: Psychedelic Bart a.k.a. Psycho Bart

Name: Psychedelic Bart a.k.a. Psycho Bart

Debunking the pyramid and greater fool theory myth about Bitcoin.

Debunking the pyramid and greater fool theory myth about Bitcoin.

The uptrend period when Bitcoin approached $ 18,000 and what's going on reminds us of Cycle Theory in the past, as well as the uptrend of 2016 - 2017, simply because the market could change. change, but human psychology is the same. We will look back at the two phases: 2016-2017 and the current period, so that investors can draw their own conclusions about what to do when the market is in the FOMO phase.

The uptrend period when Bitcoin approached $ 18,000 and what's going on reminds us of Cycle Theory in the past, as well as the uptrend of 2016 - 2017, simply because the market could change. change, but human psychology is the same. We will look back at the two phases: 2016-2017 and the current period, so that investors can draw their own conclusions about what to do when the market is in the FOMO phase.

Bitcoin is a decentralized, distributed piece of software that converts electricity and processing power into indisputably accurate records. Thus Bitcoin is allowing its users to utilize the Internet to perform the traditional functions of money like transacting value.

Bitcoin is a decentralized, distributed piece of software that converts electricity and processing power into indisputably accurate records. Thus Bitcoin is allowing its users to utilize the Internet to perform the traditional functions of money like transacting value.

“Bitcoin is the ultimate hedge to inflation. Gold is scarce, but its supply actually is slowly increasing, whereas Bitcoin supply is stuck at 21 million."

“Bitcoin is the ultimate hedge to inflation. Gold is scarce, but its supply actually is slowly increasing, whereas Bitcoin supply is stuck at 21 million."

For more background and history on the Bitcoin Bull Market Diaries check out Bitcoin Bull Market Diaries Volume 1 Interview with Hodlonaut.Crypto Meme Central is one of my favorite Bitcoin meme makers in the game. His sarcastic and witty memes are guaranteed to trigger the very people he pokes fun at.

For more background and history on the Bitcoin Bull Market Diaries check out Bitcoin Bull Market Diaries Volume 1 Interview with Hodlonaut.Crypto Meme Central is one of my favorite Bitcoin meme makers in the game. His sarcastic and witty memes are guaranteed to trigger the very people he pokes fun at.

Stock-to-Flow predicts bitcoin's price will stay above $100,000 from summer to the end of this year. What if that doesn't happen?

Stock-to-Flow predicts bitcoin's price will stay above $100,000 from summer to the end of this year. What if that doesn't happen?

On September 23, 2019, Bakkt will finally launch physically-settled bitcoin futures contracts. According to everybody, this single event will send bitcoin’s price to the moon.

On September 23, 2019, Bakkt will finally launch physically-settled bitcoin futures contracts. According to everybody, this single event will send bitcoin’s price to the moon.

Today (11 may 2020) it's a very important day for Bitcoin. Today we will have the halving!

Today (11 may 2020) it's a very important day for Bitcoin. Today we will have the halving!

Bitcoin mining rigs have been the Gordian knot tying the price of bitcoin and at the same time deciding the path that crypto adoption process should follow. Considering the history of bitcoin halving, you will notice that miners used to get a bigger slice in revenue as compared to now and that cost is still set to go lower after the upcoming 2020 halving.

Bitcoin mining rigs have been the Gordian knot tying the price of bitcoin and at the same time deciding the path that crypto adoption process should follow. Considering the history of bitcoin halving, you will notice that miners used to get a bigger slice in revenue as compared to now and that cost is still set to go lower after the upcoming 2020 halving.

Applying the financial meter stick for evaluating risk-adjusted returns of a (digital) asset, portfolio, or strategy.

Applying the financial meter stick for evaluating risk-adjusted returns of a (digital) asset, portfolio, or strategy.

Cryptocurrency has an odd and insular community.

Cryptocurrency has an odd and insular community.

A look at pricing methods of Bitcoin in the context of the Stock to Flow Method and the upcoming halving.

A look at pricing methods of Bitcoin in the context of the Stock to Flow Method and the upcoming halving.

"Where can I find the famous title of The Times in Bitcoin blockchain? Is the page saved into the blockchain?"

"Where can I find the famous title of The Times in Bitcoin blockchain? Is the page saved into the blockchain?"

Why the blockchain and cryptocurrency revolution is something to be embraced.

Why the blockchain and cryptocurrency revolution is something to be embraced.

This article is about the haves and the have-nots.

This article is about the haves and the have-nots.

For more background and history on the Bitcoin Bull Market Diaries check out Bitcoin Bull Market Diaries Volume 1 Interview with Hodlonaut.

For more background and history on the Bitcoin Bull Market Diaries check out Bitcoin Bull Market Diaries Volume 1 Interview with Hodlonaut.

Most people know Matt Odell from the Tales From the Crypt podcast he co-hosts with Marty Bent. He is also cofounder of Final Message, Bitcoin Citadel and an advisor for Bottlepay and givebitcoin.

Embrace uncertainty. It’s the only reason we have this amazing investment opportunity.

Embrace uncertainty. It’s the only reason we have this amazing investment opportunity.

David Bennett has been a vocal proponent of Bitcoin since 2015 and hosts the "Bitcoin And..." podcast where he features a variety of guests that discuss various Bitcoin topics.

David Bennett has been a vocal proponent of Bitcoin since 2015 and hosts the "Bitcoin And..." podcast where he features a variety of guests that discuss various Bitcoin topics.

When Satoshi Nakamoto first published the idea of Bitcoin, the very first comment was about scalability and how the Bitcoin proposal does not allow for scaling. Now, 10 years later, scalability is still a problem for Bitcoin.

When Satoshi Nakamoto first published the idea of Bitcoin, the very first comment was about scalability and how the Bitcoin proposal does not allow for scaling. Now, 10 years later, scalability is still a problem for Bitcoin.

Caption: Chaintimes

Caption: Chaintimes

An overview of bitocin's bull cycle using on-chain analysis. Can bitcoin go higher? Read more to find out.

An overview of bitocin's bull cycle using on-chain analysis. Can bitcoin go higher? Read more to find out.

My understanding and appreciation of Bitcoin has been shaped by a handful of essays that brilliantly capture its unique properties and potential.

My understanding and appreciation of Bitcoin has been shaped by a handful of essays that brilliantly capture its unique properties and potential.

What sets these authors apart is that they do not dictate WHAT to think, but rather HOW to think BETTER about Bitcoin.

Happy reading.

On this day, as everyone knows, Halloween is celebrated, a holiday that is not very clear its origin, especially for the word that could derive from the Scottish variant "All Hallows'Eve" but others trace it back to the character "Jack O ' Lantern” that condemned by the devil to wander at night with a hollowed pumpkin with a candle inside, and then from the word hollowing it became Halloween.

On this day, as everyone knows, Halloween is celebrated, a holiday that is not very clear its origin, especially for the word that could derive from the Scottish variant "All Hallows'Eve" but others trace it back to the character "Jack O ' Lantern” that condemned by the devil to wander at night with a hollowed pumpkin with a candle inside, and then from the word hollowing it became Halloween.

Trading Bitcoin futures is a great way to gain exposure to cryptocurrency. Over a dozen different platforms offer such services, each with their individual fees. Finding the lowest fees on the market will directly influence one's potential profits.

Trading Bitcoin futures is a great way to gain exposure to cryptocurrency. Over a dozen different platforms offer such services, each with their individual fees. Finding the lowest fees on the market will directly influence one's potential profits.

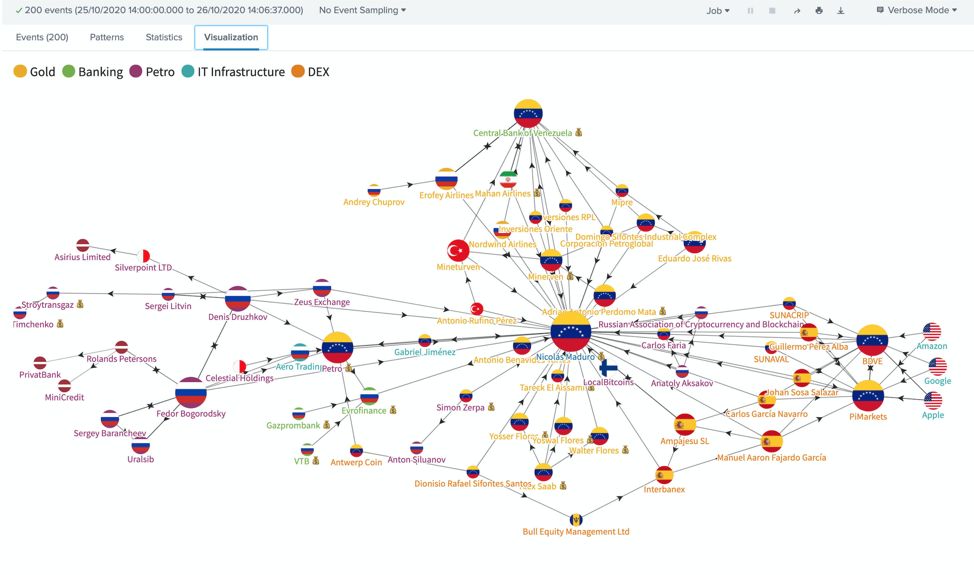

Venezuela can now interact with trading partners instantly and globally without touching US-controlled payment rails

Venezuela can now interact with trading partners instantly and globally without touching US-controlled payment rails

I admit it. I’m tsundere for Bitcoin. One could say I both love the leading cryptocurrency with all of my heart and hate its hard-coded consensus guts.

I admit it. I’m tsundere for Bitcoin. One could say I both love the leading cryptocurrency with all of my heart and hate its hard-coded consensus guts.

Hey!

Hey!

Satoshi himself had to address Bitcoins energy consumption concerns, so let’s deep dive into why Bitcoin uses energy, and how it’s used.

Satoshi himself had to address Bitcoins energy consumption concerns, so let’s deep dive into why Bitcoin uses energy, and how it’s used.

this is derived from a hackernoon community thread. these answers are by @BeastlyBeast.

this is derived from a hackernoon community thread. these answers are by @BeastlyBeast.

Cryptocurrencies like Bitcoin are volatile. They are hard to transact and even harder to understand. Most people wouldn’t consider them an asset class, never mind a viable form of money. So what does it tell us that a debate has begun as to whether crypto is a good hedge against everything else?

Cryptocurrencies like Bitcoin are volatile. They are hard to transact and even harder to understand. Most people wouldn’t consider them an asset class, never mind a viable form of money. So what does it tell us that a debate has begun as to whether crypto is a good hedge against everything else?

Financial uncertainty makes people do strange things.

Financial uncertainty makes people do strange things.

Bitcoin isn’t exactly a safe haven asset yet but its monetary policy and its long-term trajectory shows that it’s working it’s way there.

Bitcoin isn’t exactly a safe haven asset yet but its monetary policy and its long-term trajectory shows that it’s working it’s way there.

For bitcoiners, it is something of a parlor game to think of ways Bitcoin could be killed.

For bitcoiners, it is something of a parlor game to think of ways Bitcoin could be killed.

I first heard about Bitcoin in December 2017, at the peak of the bubble. My college roommates and I were drawing J curves on a whiteboard, predicting $100k Bitcoin and feeling FOMO for not getting in earlier.

I first heard about Bitcoin in December 2017, at the peak of the bubble. My college roommates and I were drawing J curves on a whiteboard, predicting $100k Bitcoin and feeling FOMO for not getting in earlier.

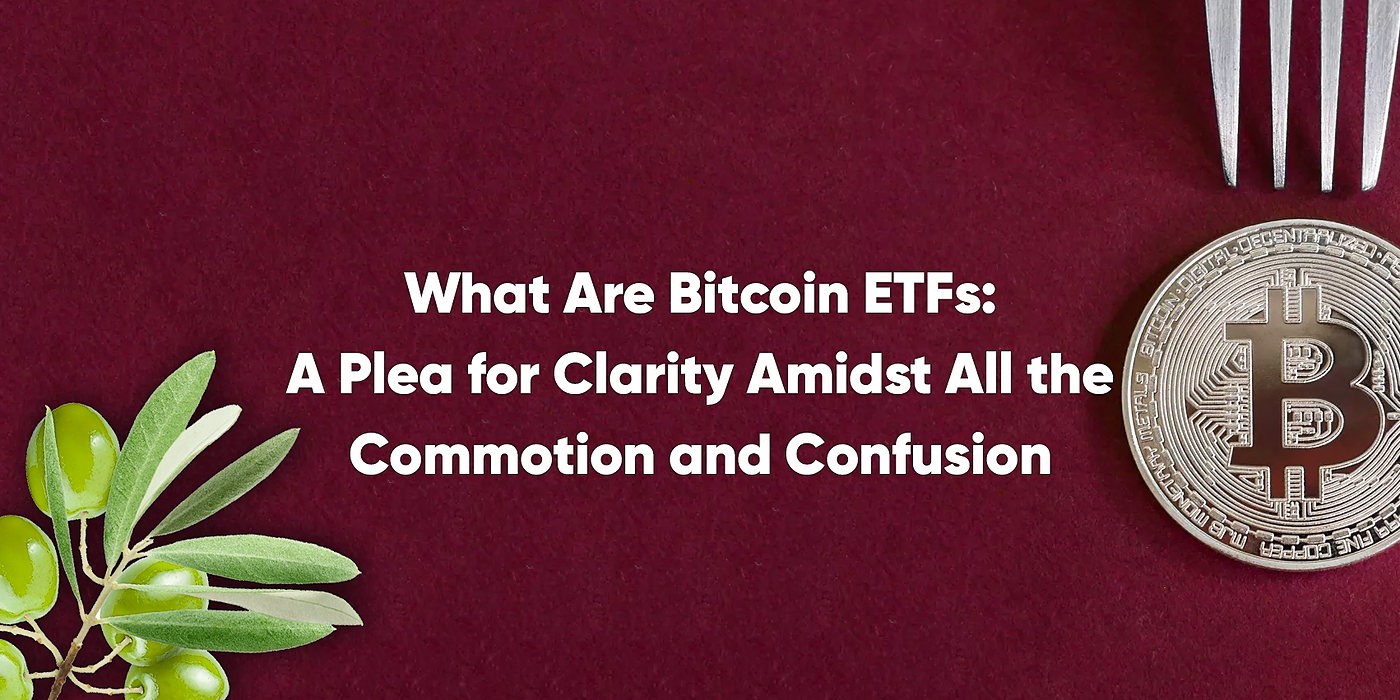

Today, Bitcoin ETFs are discussed at length by many in the media, yet surprisingly, very few actually have a deep understanding of these ETFs, with many of the subject’s details being hidden beneath the surface of the all-too-often unintelligible highfalutin jargon and Einstein-level financial gobbledygook.

Today, Bitcoin ETFs are discussed at length by many in the media, yet surprisingly, very few actually have a deep understanding of these ETFs, with many of the subject’s details being hidden beneath the surface of the all-too-often unintelligible highfalutin jargon and Einstein-level financial gobbledygook.

The cryptocurrency industry has just experienced the most anticipated event, Bitcoin (BTC) 2020 halving. The last 12.5 Bitcoin block has been mined by F2Pool and encoded the message of “NYTimes 09/Apr/2020 With $2.3T Injection, Fed’s Plan Far Exceeds 2008 Rescue.” paying tribute to Satoshi Nakamoto. Antpool was in luck and mined the first 6.25 Bitcoin block.

The cryptocurrency industry has just experienced the most anticipated event, Bitcoin (BTC) 2020 halving. The last 12.5 Bitcoin block has been mined by F2Pool and encoded the message of “NYTimes 09/Apr/2020 With $2.3T Injection, Fed’s Plan Far Exceeds 2008 Rescue.” paying tribute to Satoshi Nakamoto. Antpool was in luck and mined the first 6.25 Bitcoin block.

Hint: We're Turning Up the Heat on Bitcoin Stories. Only the best will make the cut.

Hint: We're Turning Up the Heat on Bitcoin Stories. Only the best will make the cut.

This article describes the Bitcoin Halving effect on price and shows how Bitcoin's price continues to respect its historically recurring price tendencies

This article describes the Bitcoin Halving effect on price and shows how Bitcoin's price continues to respect its historically recurring price tendencies

During the bitter cold darkness of the last Bitcoin bear market I launched a series of interviews called the Bitcoin Bear Market Diaries. Despite the fact that Bitcoin had significantly dropped in value there still remained a core group of Bitcoiners who were unphased and determined that Bitcoin would bounce back.

During the bitter cold darkness of the last Bitcoin bear market I launched a series of interviews called the Bitcoin Bear Market Diaries. Despite the fact that Bitcoin had significantly dropped in value there still remained a core group of Bitcoiners who were unphased and determined that Bitcoin would bounce back.

We take a look at Bitcoin from the technical perspective

We take a look at Bitcoin from the technical perspective

About 700 years before Sweden issued the first European banknotes in 1661, China cracked their head on how they could lighten the load of the people carrying copper coins everywhere they go.

About 700 years before Sweden issued the first European banknotes in 1661, China cracked their head on how they could lighten the load of the people carrying copper coins everywhere they go.

There is an old saying in trading circles that goes “buy the rumour and sell the news”. As rumours of impending lockdowns and travel bans spread in late February, uncertainty was sowed in international financial markets.

There is an old saying in trading circles that goes “buy the rumour and sell the news”. As rumours of impending lockdowns and travel bans spread in late February, uncertainty was sowed in international financial markets.

In the Beginning...

Bitcoin false narratives debunked , bitcoin mining, bitcoin illicit activity, bitcoin CIA, Bitcoin use cases

Bitcoin false narratives debunked , bitcoin mining, bitcoin illicit activity, bitcoin CIA, Bitcoin use cases

For a digital currency to function, constituent gears have to mesh together to create a perfect system. Transaction confirmation is a vital cog that helps to complete this system.

For a digital currency to function, constituent gears have to mesh together to create a perfect system. Transaction confirmation is a vital cog that helps to complete this system.

Imagine I told you I created a technology that could revolutionize finance and governance. As the #1 competitor in a $100 trillion market, it has a massive first-mover advantage. Thousands of developers use its technology and several billionaires have launched new ventures to bring it more value, utility, and positive attention.

Imagine I told you I created a technology that could revolutionize finance and governance. As the #1 competitor in a $100 trillion market, it has a massive first-mover advantage. Thousands of developers use its technology and several billionaires have launched new ventures to bring it more value, utility, and positive attention.

About a year ago, I was talking to someone about how difficult it was to get myself to write. I had been working on a book for O’Reilly and Associates for about 9 months at that point and had talked to other authors who acknowledged the same problem. Many authors find that books take a long time to write with 2 years being the norm. The 14 months that I took for my book was relatively fast, according to my editors.

About a year ago, I was talking to someone about how difficult it was to get myself to write. I had been working on a book for O’Reilly and Associates for about 9 months at that point and had talked to other authors who acknowledged the same problem. Many authors find that books take a long time to write with 2 years being the norm. The 14 months that I took for my book was relatively fast, according to my editors.

Her mistake was that she bought a bulk amount (to her) at once. And this is the worst way for regular people to invest in crypto.

Her mistake was that she bought a bulk amount (to her) at once. And this is the worst way for regular people to invest in crypto.

First things first, I refer to Bitcoin index funds as something that tracks Bitcoin’s price performance. While many index funds in stock market track a basket of underlying assets, most Bitcoin index funds track only Bitcoin. Bitcoin index funds are probably the easiest for beginners to start with.

First things first, I refer to Bitcoin index funds as something that tracks Bitcoin’s price performance. While many index funds in stock market track a basket of underlying assets, most Bitcoin index funds track only Bitcoin. Bitcoin index funds are probably the easiest for beginners to start with.

The objective of this series of posts is to show why Bitcoin is a better form of money than the ones we currently use. For that, however, we first need to think about some fundamental concepts without which considering Bitcoin in a serious way is impossible.

The objective of this series of posts is to show why Bitcoin is a better form of money than the ones we currently use. For that, however, we first need to think about some fundamental concepts without which considering Bitcoin in a serious way is impossible.

Balinese cockfights and cryptocurrencies, can you think of two more unrelated topics? You’d be surprised then to discover that at closer inspection, looking beyond blockchains and metal spurs, the social dynamics taking place around cockfight rings can help us understand those around cryptocurrencies.

Balinese cockfights and cryptocurrencies, can you think of two more unrelated topics? You’d be surprised then to discover that at closer inspection, looking beyond blockchains and metal spurs, the social dynamics taking place around cockfight rings can help us understand those around cryptocurrencies.

Previous Year: Everything wrong with Bitcoin in 2019

Previous Year: Everything wrong with Bitcoin in 2019

After 30 years of trial and error, this new, pristine asset class called Bitcoin has emerged, it’s here, staring at you in the face. It works.

After 30 years of trial and error, this new, pristine asset class called Bitcoin has emerged, it’s here, staring at you in the face. It works.

Everybody expects bitcoin’s price to hit $100,000 eventually. Stock-to-Flow models, regression analysis, and lots of other models predict it will happen.

Everybody expects bitcoin’s price to hit $100,000 eventually. Stock-to-Flow models, regression analysis, and lots of other models predict it will happen.

The thinking and the strategies behind Saylor´s bold bitcoin investing.

The thinking and the strategies behind Saylor´s bold bitcoin investing.

With bitcoin’s price booming and its market cap reaching all-time highs, you can excuse people for getting excited. When money talks, people listen.

With bitcoin’s price booming and its market cap reaching all-time highs, you can excuse people for getting excited. When money talks, people listen.

At 5:55 PM EST on May 11, 2020, the third Bitcoin Halving will occur. Over the last several weeks, the price of Bitcoin has soared nearly 30% as speculators and long-term hodlers are accumulating ahead of the highly anticipated event.

At 5:55 PM EST on May 11, 2020, the third Bitcoin Halving will occur. Over the last several weeks, the price of Bitcoin has soared nearly 30% as speculators and long-term hodlers are accumulating ahead of the highly anticipated event.

Millions of people still wonder. Can bitcoin and mainstream finance (fiat money) ever get along?

Millions of people still wonder. Can bitcoin and mainstream finance (fiat money) ever get along?

Few people ask me about the social, political, and economic impact of cryptographically-secure, time-stamped distributed ledgers.

Few people ask me about the social, political, and economic impact of cryptographically-secure, time-stamped distributed ledgers.

When it comes to Bitcoin or its price, interested readers will find thousands of articles on the Internet. The range here extends from apocalyptic scenarios to extremely positive forecasts. On the one hand, it underlines the volatility and the unpredictable nature of the digital currency. On the other hand, the range shows that, while it is easy to obtain information in the digital age, it is all the more difficult to find high-quality information. Neutral and objective considerations are rare, as self-interest often accompanies the valuation of an asset.

When it comes to Bitcoin or its price, interested readers will find thousands of articles on the Internet. The range here extends from apocalyptic scenarios to extremely positive forecasts. On the one hand, it underlines the volatility and the unpredictable nature of the digital currency. On the other hand, the range shows that, while it is easy to obtain information in the digital age, it is all the more difficult to find high-quality information. Neutral and objective considerations are rare, as self-interest often accompanies the valuation of an asset.

Stay up to date with my latest tweets here: @BoudjemaaAdam

Stay up to date with my latest tweets here: @BoudjemaaAdam

Ever wondered why some bitcoin traders are drawn to go out scalping every fast-rolling wave gliding across the screen while others will sit in the comfort of the beach club—mojito in hand—and play the tide instead?

Ever wondered why some bitcoin traders are drawn to go out scalping every fast-rolling wave gliding across the screen while others will sit in the comfort of the beach club—mojito in hand—and play the tide instead?

Bitcoin is an extension of ourselves, it’s our money — the people’s money. We can choose to transact with whomever, wherever, whenever, and for whatever we want — because Bitcoin does not discriminate.

Bitcoin is an extension of ourselves, it’s our money — the people’s money. We can choose to transact with whomever, wherever, whenever, and for whatever we want — because Bitcoin does not discriminate.

The relationship between Bitcoin and Gold is one of the dynamics that seems to constantly capture the minds of financial analysts. Recently, there have been a series of new articles claiming an increasing “correlation” between Bitcoin and Gold and the phenomenon seems to be constantly debated in financial media outlets like CNBC or Bloomberg.

The relationship between Bitcoin and Gold is one of the dynamics that seems to constantly capture the minds of financial analysts. Recently, there have been a series of new articles claiming an increasing “correlation” between Bitcoin and Gold and the phenomenon seems to be constantly debated in financial media outlets like CNBC or Bloomberg.

In the classic “diffusion of innovations” theory, new technology has to progress from innovators to early adopters before it can go mainstream.

In the classic “diffusion of innovations” theory, new technology has to progress from innovators to early adopters before it can go mainstream.

Read full story by Daniel Sangyoon Kim

Read full story by Daniel Sangyoon Kim

For more background and history on the Bitcoin Bull Market Diaries check out Bitcoin Bull Market Diaries Volume 1 Interview with Hodlonaut.

For more background and history on the Bitcoin Bull Market Diaries check out Bitcoin Bull Market Diaries Volume 1 Interview with Hodlonaut.

Brian Lockhart has been into Bitcoin since 2010 and currently works at Casa doing product managment for their Bitcoin + Lightning node product. Brian also runs the Seattle Bitcoin Meetup and is well known in the Bitcoin community.

As I briefly explained in this other post, money is something that has always interested me.

As I briefly explained in this other post, money is something that has always interested me.

The uncertainties surrounding the evolution of the Covid-19 pandemic and its impact on the global economy are gripping both the people and the markets with fear. A global recession is now the best case outcome also for JP Morgan while Goldman Sachs foresees the possibility of a second great depression.

The uncertainties surrounding the evolution of the Covid-19 pandemic and its impact on the global economy are gripping both the people and the markets with fear. A global recession is now the best case outcome also for JP Morgan while Goldman Sachs foresees the possibility of a second great depression.

Stay up to date with my latest tweets here: @BoudjemaaAdam

Stay up to date with my latest tweets here: @BoudjemaaAdam

Here are the key players in Grayscale Bitcoin Trust (GBTC), and this is how they are likely to impact prices over the coming months.

Here are the key players in Grayscale Bitcoin Trust (GBTC), and this is how they are likely to impact prices over the coming months.

On August 3rd, 2019, I found myself at the front door of a large suburban home in Redwood City, struggling to enter the correct key code. It was four in the afternoon — the house was backlit by a golden Californian sun floating in a deep blue sky — and I had a week’s worth of clothes and equipment in my backpack. Eventually, my friend Alena opened the door, saving me from further embarrassment. She’d been there an hour already, she explained, but everyone else was still in transit.

On August 3rd, 2019, I found myself at the front door of a large suburban home in Redwood City, struggling to enter the correct key code. It was four in the afternoon — the house was backlit by a golden Californian sun floating in a deep blue sky — and I had a week’s worth of clothes and equipment in my backpack. Eventually, my friend Alena opened the door, saving me from further embarrassment. She’d been there an hour already, she explained, but everyone else was still in transit.

Our strategy hit a 26% ROI trade during last week's bitcoin crash. If you pay attention you might be able to catch the next ride too.

Our strategy hit a 26% ROI trade during last week's bitcoin crash. If you pay attention you might be able to catch the next ride too.

When could Bitcoin peak in this cycle?

When could Bitcoin peak in this cycle?

A Public Service Announcement to Bitcoin Newbs: How to drown out the noise, stack sats and stay focused on the Bitcoin bull cycle.

A Public Service Announcement to Bitcoin Newbs: How to drown out the noise, stack sats and stay focused on the Bitcoin bull cycle.

In today's world of cancel culture, doxxing, and collusion between tech companies and government agencies to harass and interfere with businesses that offend their delicate sensibilities, there is a need for the ability to conduct online business in a way that protects the privacy of the business, its employees, suppliers and customers.

In today's world of cancel culture, doxxing, and collusion between tech companies and government agencies to harass and interfere with businesses that offend their delicate sensibilities, there is a need for the ability to conduct online business in a way that protects the privacy of the business, its employees, suppliers and customers.

For somebody who hates bitcoin, Warren Buffett sure got one thing right

For somebody who hates bitcoin, Warren Buffett sure got one thing right

Most people know Michael Caras as The Bitcoin Rabbi and for his book, “Bitcoin Money: A Tale of Bitville Discovering Good Money.” Michael got into Bitcoin in 2017 and his passion and enthusiam to teach people about Bitcoin has earned him respect in the community. He may not be an OG bitcoiner, but his fresh perspective is a great addition to the Bitcoin Bear Market Diaries.

Most people know Michael Caras as The Bitcoin Rabbi and for his book, “Bitcoin Money: A Tale of Bitville Discovering Good Money.” Michael got into Bitcoin in 2017 and his passion and enthusiam to teach people about Bitcoin has earned him respect in the community. He may not be an OG bitcoiner, but his fresh perspective is a great addition to the Bitcoin Bear Market Diaries.

For some time now I’ve been making an unassailable and unchallenged argument that Bitcoin and Bitcoin services are no different to the monies and services found in video games. Now, thanks to my favourite gamer, we have one of the best examples yet of “Bitcoin Doublethink”, second only to the very cute Pigsby which uses a “Blockchain” for its database.

For some time now I’ve been making an unassailable and unchallenged argument that Bitcoin and Bitcoin services are no different to the monies and services found in video games. Now, thanks to my favourite gamer, we have one of the best examples yet of “Bitcoin Doublethink”, second only to the very cute Pigsby which uses a “Blockchain” for its database.

Since its launch in 2009, Bitcoin has continued to thrill and confuse the global financial markets.

Since its launch in 2009, Bitcoin has continued to thrill and confuse the global financial markets.

How emerging economies can lead the crypto revolution in commercial banking and enjoy an economic renaissance based on sound money

How emerging economies can lead the crypto revolution in commercial banking and enjoy an economic renaissance based on sound money

When a pseudonymous programmer introduced “a new electronic cash system that’s fully peer-to-peer, with no trusted third party” to an online mailing list in 2008, very few paid attention. Ten years later, and against all odds, this upstart autonomous decentralized software offers an globally-accessible alternative to modern central banks.

When a pseudonymous programmer introduced “a new electronic cash system that’s fully peer-to-peer, with no trusted third party” to an online mailing list in 2008, very few paid attention. Ten years later, and against all odds, this upstart autonomous decentralized software offers an globally-accessible alternative to modern central banks.

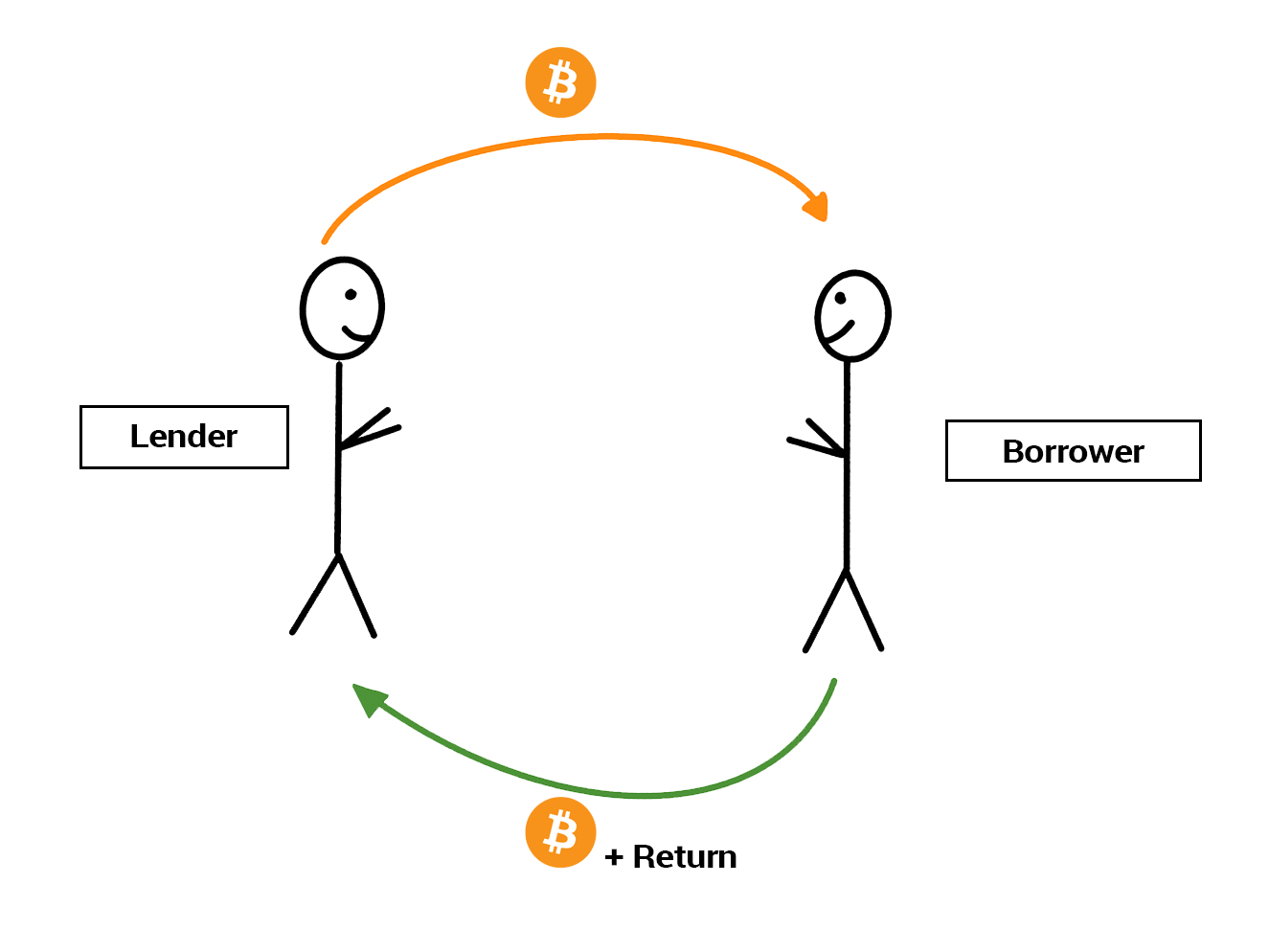

What is Bitcoin Lending?

What is Bitcoin Lending?

One of Bitcoin’s strengths and the thing that makes it unique in the finance world is its radical transparency. Blockchain data is like a window, you can see right through it.

One of Bitcoin’s strengths and the thing that makes it unique in the finance world is its radical transparency. Blockchain data is like a window, you can see right through it.

Uncontrolled use of deanonymizing technologies, such as blockchain forensics and darknet monitoring tools can threaten long-term security and safety of digital ecosystems.

Uncontrolled use of deanonymizing technologies, such as blockchain forensics and darknet monitoring tools can threaten long-term security and safety of digital ecosystems.

TL;DR: Contrary to the prevailing “fractional reserve” narrative of money creation in the crypto community, Central Banks today admit to money creation in the economy by individual banks as being more nefarious than previously propagated in mainstream economic and financial disquisition. Money is in fact empirically created ex nihilo, where loans create deposits (and bank lending is not reserve constrained). Owing to its superior monetary attributes as a store-of-value (SoV), the implication of this empirical finding further justifies Bitcoin’s role as the best alternative for the average citizen, in the 21st century, to hedge against the frequent financial and economic crises we experience worldwide triggered by our debt/credit-based economic system.

TL;DR: Contrary to the prevailing “fractional reserve” narrative of money creation in the crypto community, Central Banks today admit to money creation in the economy by individual banks as being more nefarious than previously propagated in mainstream economic and financial disquisition. Money is in fact empirically created ex nihilo, where loans create deposits (and bank lending is not reserve constrained). Owing to its superior monetary attributes as a store-of-value (SoV), the implication of this empirical finding further justifies Bitcoin’s role as the best alternative for the average citizen, in the 21st century, to hedge against the frequent financial and economic crises we experience worldwide triggered by our debt/credit-based economic system.

Bitcoin confuses a lot of people because they get lost in the jargon (decentralized, validator, etc.).

Bitcoin confuses a lot of people because they get lost in the jargon (decentralized, validator, etc.).

Cryptocurrency has revolutionized how global citizens view what the definition of currency may mean. Even at a young age, most people understood the power of currency. We perceived money as a mystical object that provided access to our wishes: candy, food, and fun.

Cryptocurrency has revolutionized how global citizens view what the definition of currency may mean. Even at a young age, most people understood the power of currency. We perceived money as a mystical object that provided access to our wishes: candy, food, and fun.

Everybody involved in the crypto ecosystem knows the importance of crypto exchanges. Often times, the CEOs of these exchanges are seen as the rockstars of the modern finance world — yet nobody seems to know about and completely understand the importance of the OTC market.